Credit Club is a licensed Canadian payday lender, providing short-term loans to customers in Ontario, British Columbia and Nova Scotia.

Established in 2012, it is a fully online platform that allows borrowers to apply 24/7, even on weekends and holidays, thanks to its innovative automated approval system.

APR range 90%-391.07%.

Fortunly Rating

Fortunly's Rating: Our editorial team determines the rating based on a set of evaluation criteria developed for each product and service category.

- Fast funding times

- Fixed fees

- Completely online process

- Automated approval system

- No credit check required

- Transparent rates

- High APRs

Credit Club Overview

Credit Club prides itself on providing extremely quick funding to new and returning borrowers, with the whole process taking as little as 30 minutes.

The platform also stands out due to its no-credit-check policy, and is in full compliance with provincial regulation.

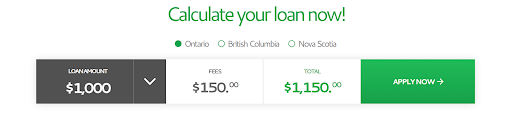

You’ll clearly see all the important information regarding interest rates, fees and repayment terms right on the website.

For example, the simple yet clear loan calculator will tell you exactly what your loan fees will amount to, depending on the loan amount you want to borrow.

Payday loans naturally come with high APRs, so before you decide to apply for one, it is best to assess your overall financial situation to ensure that you will be able to pay them off on time, which is why this open approach from Credit Club is very consumer-friendly in a usually less-so market.

Application Process

As we noted earlier, the idea behind Credit Club is to provide fast funding to borrowers in need of emergency cash. This is why the entire application process is extremely straightforward and done online, completely eliminating paperwork and in-person visits.

You’ll only need to provide basic personal information, like your email address, phone number and employment details. Credit Club stipulates that you have to have been employed with the same employer for at least three months to be eligible for a loan.

You also have to be a resident of ON, BC and NS, and be at least 18 years old, with an active chequing account in your name.

The approval process usually takes just around 30 minutes, after which you receive your funds via e-Transfer.

In some cases where a manual intervention is required, though, you may have to wait until the next business day to receive the funds.

Credit Club doesn’t conduct a credit check, so your credit rating won’t be impacted during the process.

Rates & Terms

The loans offered by Credit Club range from $100 to $1,500. First-time borrowers can borrow up to $500, while Credit Club members can apply for any loan amount that the company offers.

The company charges $15 for every $100 borrowed in all three available provinces, meaning that if you take out a $1,000 loan, you will pay $150 in fees back to Credit Club. With a standard repayment term of 14 days (next payday), this translates to a high APR that payday loans are known for, but is in line with industry standards.

Keep in mind that starting from 2025, regulations will cap the costs across all provinces to $14 per $100, offering greater protection to consumers and reflecting a positive shift toward more transparent and standardized payday loan terms in Canada.

Paying off your loan on time is crucial, as Credit Club will incur late payment or non-sufficient-fund charges if you miss out on a payment or don’t have funds in your bank account on the repayment date.

This can also incur an overdraft charge from your banks, and an annualized 30% interest rate will accrue from the repayment date.

Repayment Options

While payday loans generally don’t come with much flexibility in terms of repayment dates, if you take out a third loan within 62 days you will be able to activate an extended payment plan. The extended payment plan gives you the ability to repay your loan in three installments.

Credit Club will notify you by email three days before your loan becomes due, and funds will be automatically debited from your bank account on the due date.

If you want to pay off the loan early, you can do so without incurring any fees, and you will be eligible for a new loan one business day after your previous loan was repaid.

How Credit Club Compares to Other Payday Lenders

$100 – $1,500

Varies by province

Up to 62 days

Learn More

$100 – $1,500

Varies by province

Up to 62 days

Learn More

$300 - $1,500

Varies by province

Up to 62 days

Learn MoreCustomer Satisfaction

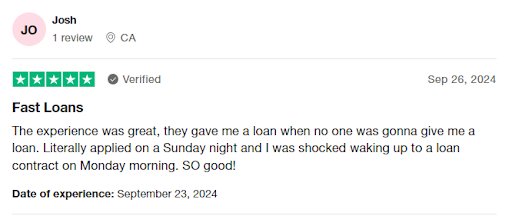

Credit Club is a licensed lender in all three provinces it operates in, and holds an A+ rating on BBB. The company is highly respected amongst borrowers, as is evident by the extremely high 4.7/5 score on Trustpilot from more than 3,200 customers.

Most customers share the same sentiment as in the example above, praising the easy loan application process and extremely fast funding times, as well as the company’s ability to automatically approve loans, even during the weekend.

The customer support can be reached via email or phone, but note that the support staff is not available during weekends. You can get in touch with the agents from 8:30am to 4:30pm from Monday to Thursday, while on Fridays the working hours end at 4:00pm.

Our Verdict

All in all, Credit Club represents one of the most reliable and secure payday lenders for residents of Ontario, British Columbia and Nova Scotia. With a fully online platform, a no-credit-check policy and incredibly fast access to funds, it can be a lifesaver for those in need of emergency cash.