Operating a rental business is not simple, especially when dealing with rent collection, tax filing, and a slew of other paperwork.

The good news is that options like Baselane exist, which provide banking, insurance and property management features tailored specifically to the needs of independent landlords, real estate investors, rental propery owners as well as renters.

Earn a welcome bonus when you open a banking account as a new customer. Terms and conditions apply.

Fortunly Rating

Fortunly's Rating: Our editorial team determines the rating based on a set of evaluation criteria developed for each product and service category.

- Apple and Google Pay support

- Cashback rewards

- Competitive APY

- Integrated bookkeeping tools

- Auto rent payments

- Free ATM withdrawals

- No property advertisement feature

Baselane Overview

Baselane is a fintech company launched in 2020, with the aim of providing independent landlords with a next-generation banking and rental management platform that will empower real estate investors to thrive.

The company offers a business checking account, automated rent collection, bookkeeping and rental propery accounting services to landlords, as well as rent payment and renters insurance services to tenants.

You can also use Baselane to create lease agreements, calculate rental rates and ROI on your rental properties, as well as find numerous services like tax preparation, loans and lines of credit through Baselane partners like Obie, TurboTax, LandFlow and Sure.

Main Features

Here’s a closer look at the features the company has to offer:

Banking for Landlords

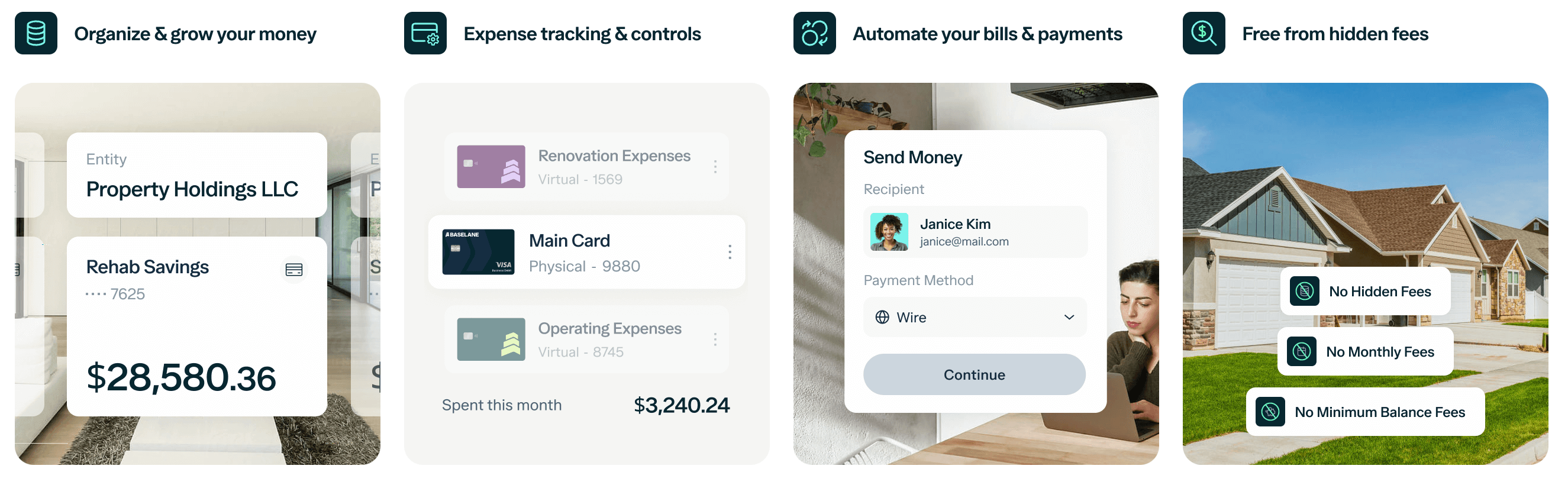

Baselane offers banking services through Blue Ridge Bank, an FDIC member. The platform allows you to open an unlimited amount of free banking accounts, either for businesses such as LLCs, Partnerships or Corporations, or for individuals like Sole Proprietors.

You also have the option to open free virtual accounts if you own multiple properties or units, in order to separate savings or to keep the security deposits separated.

The Baselane banking accounts is completely free, making it stand out from the typical business checking account offers, as those usually come with additional fees, such as monthly, ACH transfer or overdraft fees.

With Baselane banking, there are zero additional fees, and no minimum balance or deposit requirements.

Real estate investors can take advantage of an industry-high 4.46% APY and unlimited 1% cash back, even for security deposits.

Automated Rent Collection & Calculation

Rent collection is one of the most daunting tasks of running a property rental business. Baselane’s automated rent collection feature can help streamline its process as it allows landlords to easily sign up tenants and get paid in 2-3 business days.

Tenants can set up auto pay, and pay for rent via debit or credit credit cards, as well as ACH transfers, for a 2.99% fee.

Unlike other payment methods, Baselane does not have daily limits and is completely free.

As a landlord, you can recieve payments either to your Baselane or outside accounts, and you have the ability to automate payment and late fee reminders.

Baselane automates and tracks payment history as well, making it easy to look at how and when your tenants have made their payments, and if there are any outstanding rent debts left.

Rental Property Bookkeeping & Accounting

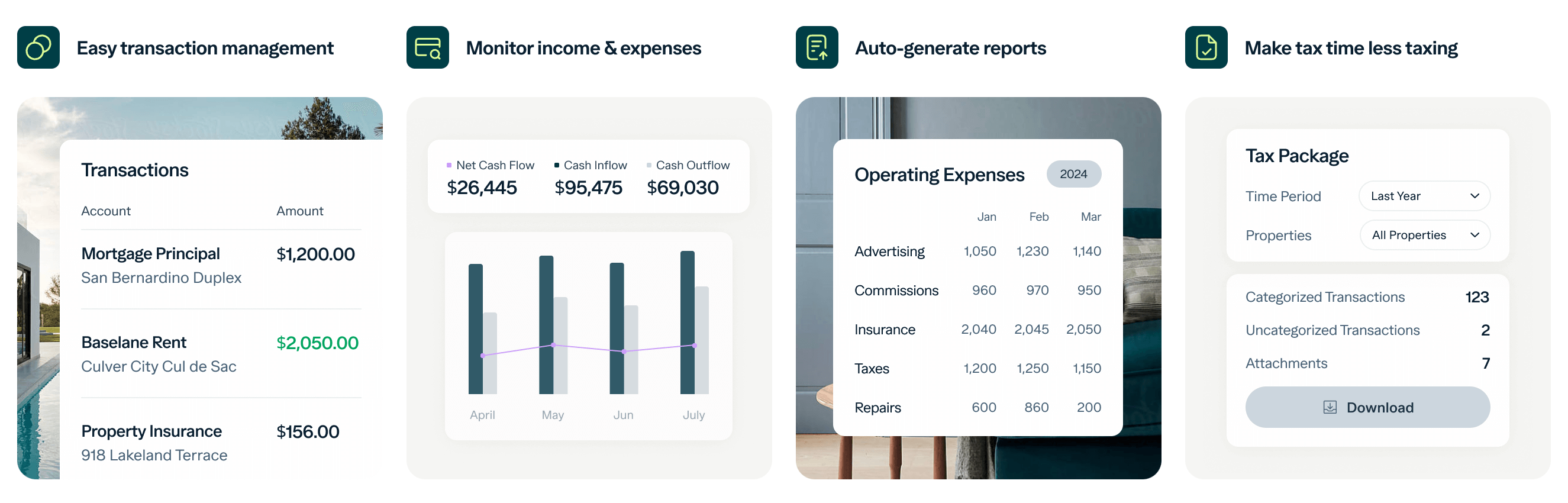

You can effortlessly keep track of your business's financial transactions using Baselane's one-click bookkeeping and accounting feature.

You can also tag each payment and add notes, easily tracking the money coming in and out of the business, categorizing the expenses and revenue in a Schedule E-based way.

The categorization can help you keep track of your finances as you'll get automated summaries of your cash flow from Baselane.

The Baselane rental property bookkeeping and accounting software features track rent payments, security deposits, property expenses, repair costs, insurance premiums, late fees, mortgage and loan payments, credit card transactions and tenant screening fees.

The platform also features tax reporting and seamless integration with bank acocunts outside its payment system.

Financial Services

Both landlords and tenants can make use of a number of financial services offered through Baselane partners, allowing you to either scale your rental business or to insure yourself as a renter.

The services currently available to Baselane customers are:

Rental Property Insurance

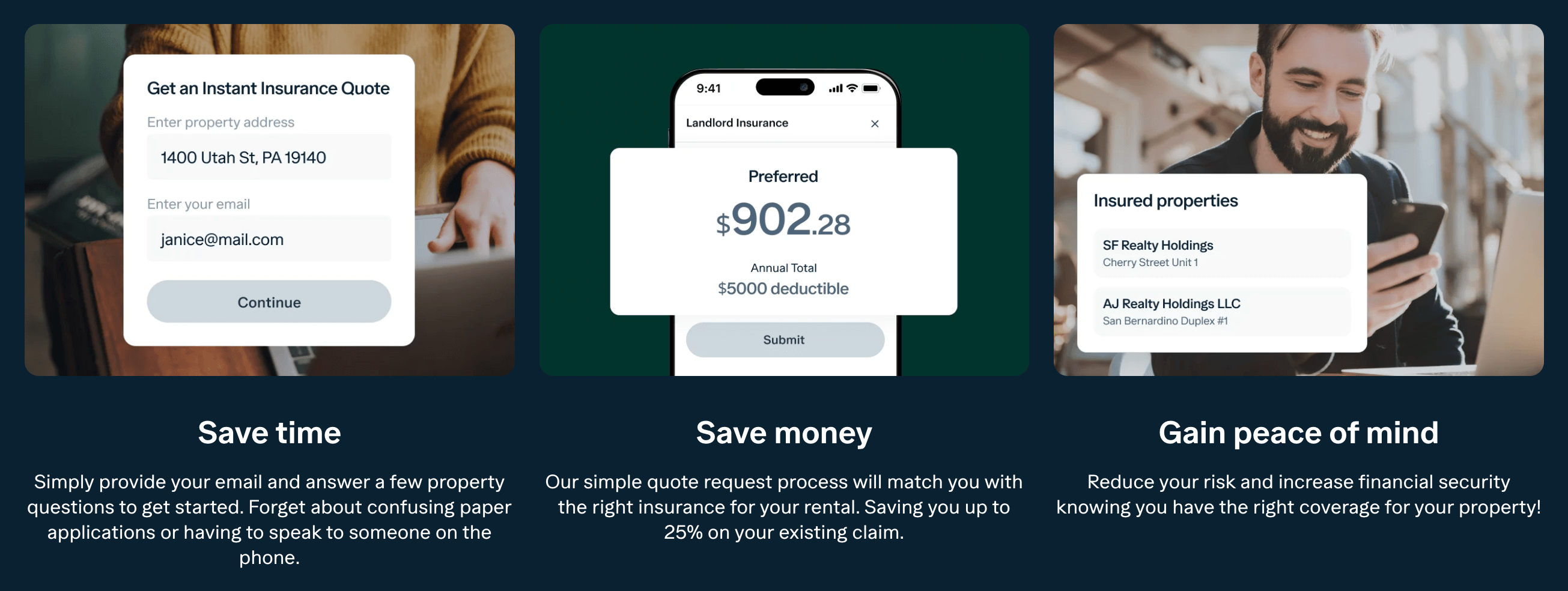

Baslane partners with Obie to provide quick access to afordable rental property insurance coverage for landlords.

You can simply enter your property address and your email address to get an instant quote, and the offer of a coverage best-suited to your personal needs as a landlord.

If you already have an existing policy with a different insurer, Baselane can save you up to 25% on average with its policy.

Lines of Credit

You can get funded for a line of credit through another Baselane partner, Landflow. Through a simple step-by-step application process accessed by clicking on the "Apply for Funding Now" button, you can find and choose the right offer for you in less than 15 minutes and be funded as fast as 24 hours later.

Renters Insurance

Renters themselves can also get their belongings insured from theft, loss and most of the forms of destruction usually covered by renters insurers.

Through Sure, which Baselane partners with to provide this service, you can also get coverage against lawsuits and medical expenses in case someone gets hurt on your property. The plans start as low as $8 per month.

Real Estate Loans

Landlords and real estate investors have the ability to apply for quick real estate loans through another one of Baselane's major partnerships. For lending products, the company's partner is Lendency, which can fund your real estate investment in 60 seconds.

Loan amounts range from $55k to $2 million, with loan types being single-family, multi-family, 5+ unit, portfolio, rehab and other loans.

There is no income verification required and you can recieve funding in as little as 10 days.

Tenant Screening

While an official, in-house tenant screening feature is 'coming soon' to Baselane's list of features, landlords can use TransUnion's tenant screening service through Baselane, and sign-up for free.

The choice who pays for the screening is up to the landlord, and starts at $25 per screening.

Legal Services

Through the partnership with Rocket Lawyer, Baselane users can get access to a complete legal service with all the real estate documents and legal advice that a landlord or a property owner may need.

For example, you can easily and quickly make legal documents such as lease agreements, eviction notices, rent increase notices, rental applications, pet lease addendums and more.

Landlords can also easily incorporate their businesses and stay protected as their businesses grow and evolve.

The legal service offer comes with free built-in electronic signatures powered by RocketSign, and there is a 7-day free trial on offer if you want to test out the Rocket Lawyer platform

Tax Preparation

Finally, Baselane offers tax preparation services through the popular tax software TurboTax, allowing you to save up to $15 on federal products.

You can do the taxes yourself, with an assistance from a tax expert or by tax experts themselves, and you'll also get access to live CPAs and EAs.

Prices start at $0 for the free edition and simple tax returns only, $99 for a tax expert-assisted service and $219 for the full service. All of the costs are paid only after you file.

Comparing Baselane to Other Similar Services

Baselane stands out from the crowd because it combines elements of two distinct industries—landlord management software and financial services.

Here’s a side-by-side comparison of Baselane’s features against its close competitors:

| Services Offered | Baselane | Avail | Hemlane | Stessa |

| Banking | ✔️ | ❌ | ❌ | ✔️ |

| Bookkeeping | ✔️ | ✔️ | ✔️ | ✔️ |

| Rent Collection | ✔️ | ✔️ | ✔️ | ✔️ |

| Reporting & Analytics | ✔️ | ❌ | ❌ | ✔️ |

| Insurance and Lending | ✔️ | ❌ | ❌ | ❌ |

| Tenant Screening | ✔️ | ✔️ | ✔️ | ✔️ |

| Applicant Tracking | ❌ | ✔️ | ✔️ | ✔️ |

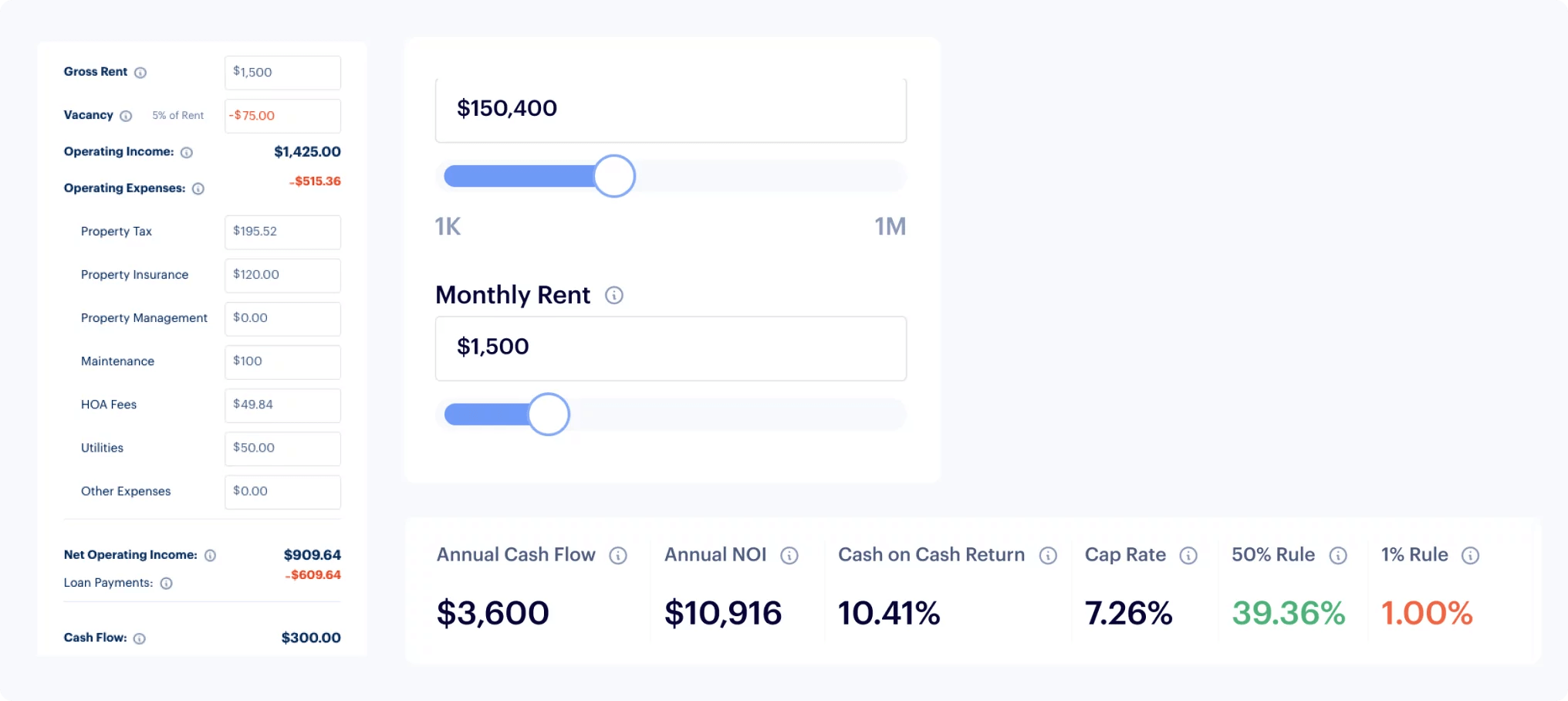

Although Baselane does not offer applicant tracking features, it has a rental performance dashboard. This provides landlords with detailed insight into their property valuations and cash flow.

Ease-of-Use

There's little to no learning curve in using the platform. It has an intuitive dashboard allows you to track payments and manage your property with just a few clicks of a button.

Baselane also features a wealth of educational resources and helpful tools, such as a rich blog and FAQ section, a rental property ROI calculator and a rental rate calculator.

Pricing

Landlords and tenants can access Baselane's features completely for free. Of course, if you take out a loan with Lendency, you must pay fees and interest in accordance with its terms and conditions.

This is the way that Baselane actually makes money, through the partnerships with financial service providers, which makes possible for the company's core services to remain free of charge.

Customer Service

Baselane's customer service is responsive and easy to reach. They have multiple communication channels, including:

- A live-chat option through the in-app messenger

- Scheduling of calls through the messenger

- Customer service hotline: 888-586-1618

- Email support: [email protected]

Customer reviews are positive, with the company holding a 4.2/5 rating on Trustpilot as of the writing of this review.

The Downsides

Just like with everything else, Baselane also has its weakness. As a platform tailored to landlords, it does not have features allowing them to advertise rentals. However, since it focuses more on the financial aspect of the business, the lack of these feature is understandable.

Final Verdict

All in all, Baselane provides a high-quality service with may be quite handy if you are an independent landlord trying to keep up with bookkeeping, rent collection, and document upkeep.

Instead of using several applications and tools, you have most of what you require in one location.