Founded on the core principle of operational independence, BrightFunded stands out from most trading firms by offering a sustainably built, in-house developed platform suitable for both new and experienced traders.

Our review will examine its offerings, and evaluate how it compares to other leading names on the market today.

Unlimited scaling plan.

Fortunly Rating

Fortunly's Rating: Our editorial team determines the rating based on a set of evaluation criteria developed for each product and service category.

- High profit split

- Potentially infinitely scaling plan

- Trade2Earn loyalty rewards

- Fast payout processing

- Great variety of account options

- Hand-crafted trading experience

- No free trial

BrightFunded Overview

Launched in 2023, BrightFunded has quickly gained a lot of traction within the trading community.

The entire technology behind it was developed in-house, including a highly sophisticated rule engine that continuously evaluates all traders, by their experienced in-house development team.

BrightFunded is open to traders worldwide, including the United States, and provides one of the most customizable and trader-friendly evaluation programs out there, with relatively lenient rules, high profit splits and flexible account size options.

The company also has an infinite scaling plan for their most successful traders, which is something we haven’t seen before, and offers a great, token-based loyalty program which rewards active traders whether they’re winning or losing trades through free evaluations, drawdown increases and even higher profit splits.

Evaluation Process

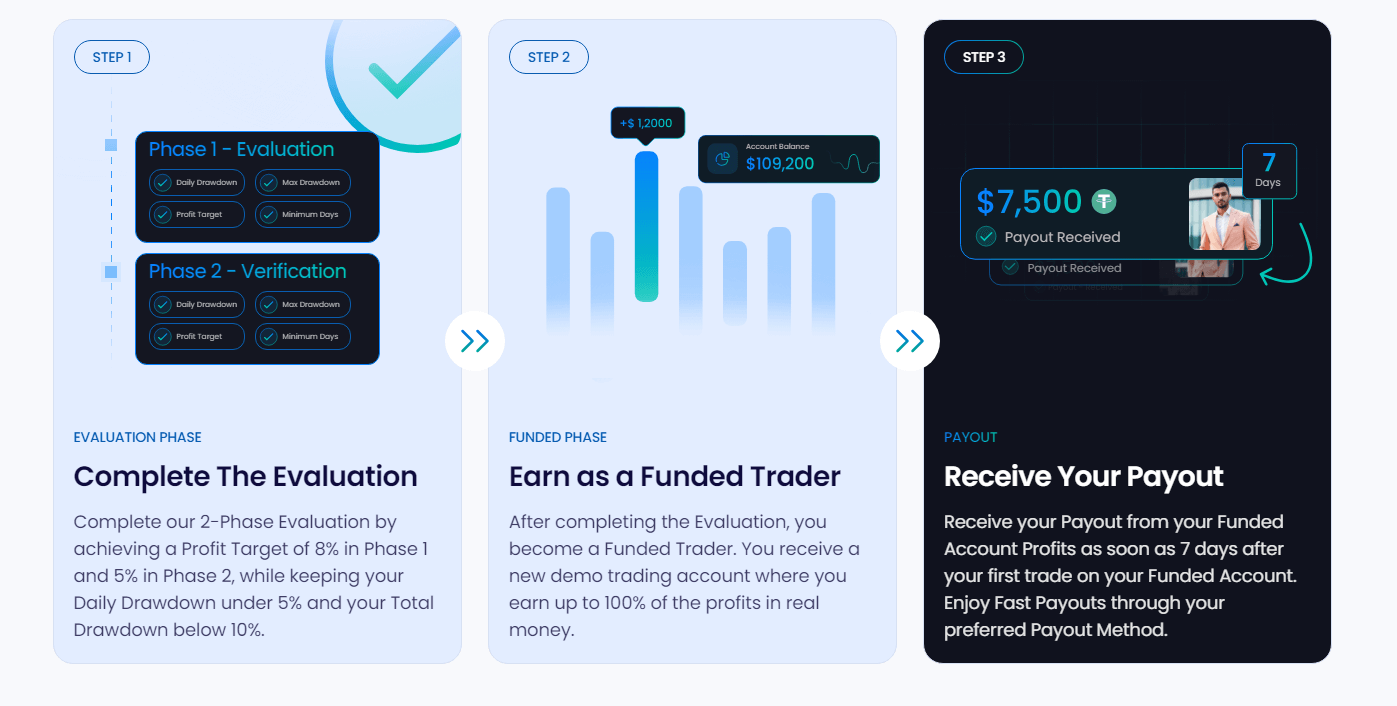

There is only one way to become a funded trader with BrightFunded, and it goes through the firm’s two-step evaluation program.

The first phase is the Evaluation phase, in which you must demonstrate your ability to hit an 8% profit target on the demo account, without breaking the daily drawdown (5%) and max total drawdown (10%) rules.

Another thing you have to consider is that the firm sets a 5-day trading minimum requirement, which means that you have to follow these rules for five trading days before progressing to the Verification phase. This requirement can, however, be reduced to zero with the “No Minimum Trading Days” add-on purchase, which can be selected during checkout.

In this phase, the profit target drops to 5%, but all the other rules remain the same, including the five-day trading requirement.

After passing the second stage successfully, you will receive a funded account, allowing you to receive up to 100% of profits you generate through trading, depending on how many scaling milestones you achieve. The default profit split is 80%, and can be increased instantly to 90% through a paid add-on.

Other available add ons allow you to remove the minimum trading days requirement, as well as the ability to receive faster payouts.

Available Plans

BrightFunded offers six different plans, all based on different planets in our Solar system, starting from the smallest plan called Pluto, and ending with the largest plan called Jupiter.

Here’s a quick overview of all the currently available account sizes, profit targets and fees:

|

Account Size |

Fee |

Phase 1 Target |

Phase 2 Target |

Max Daily Loss |

Max Total Drawdown |

|

$5,000 |

$55 |

$400 |

$250 |

5% |

10% |

|

$10,000 |

$95 |

$800 |

$500 |

5% |

10% |

|

$25,000 |

$195 |

$2,000 |

$1,250 |

5% |

10% |

|

$50,000 |

$295 |

$4,000 |

$2,500 |

5% |

10% |

|

$100,000 |

$495 |

$8,000 |

$5,000 |

5% |

10% |

|

$200,000 |

$975 |

$16,000 |

$10,000 |

5% |

10% |

Scaling Plan

As we mentioned earlier, BrightFunded features a scaling plan which not only allows you to reach a 100% profit split, but also scales indefinitely.

If you maintain a 10% profit during a four-month window, with at least two successful payouts, you will be eligible to scale your account by 30% of its original balance.

This process can then be repeated every four months, providing you with a unique potential to steadily compound your capital access.

Trade2Earn Loyalty Program

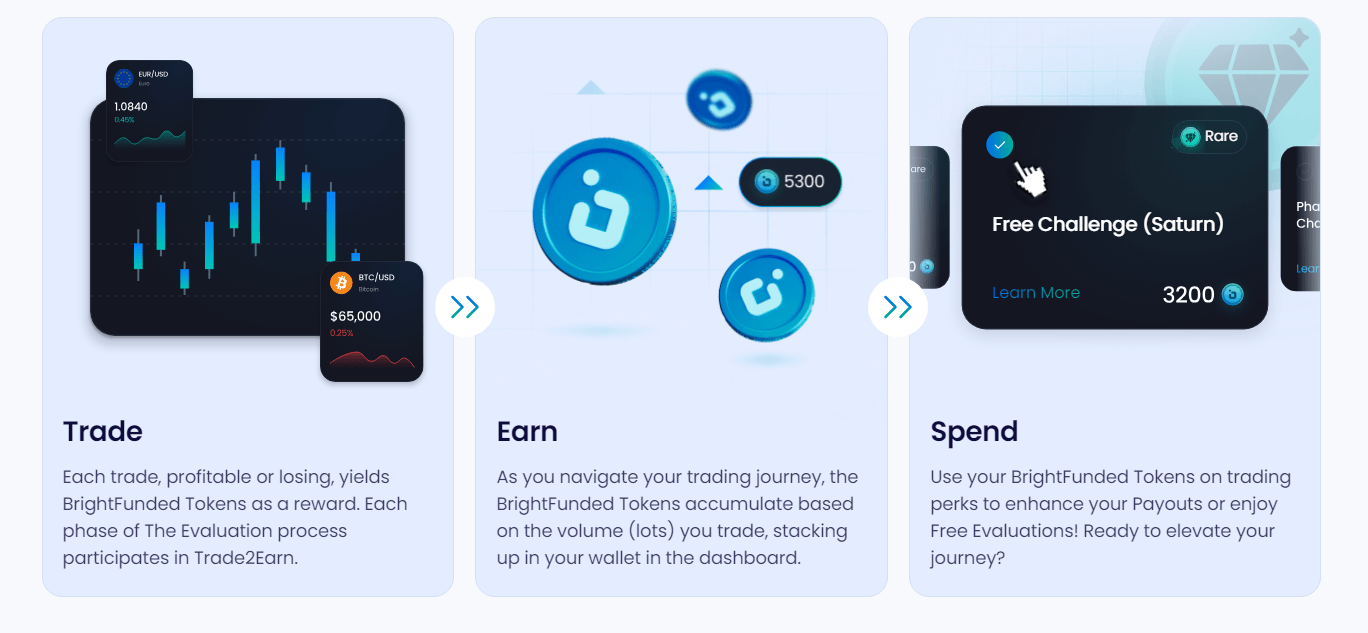

Another standout feature here is the loyalty program, which rewards active traders, whether they are winning or losing trades. Called Trade2Earn, the program rewards every single trade with tokens, based on the volume of your traders.

These tokens can then be redeemed to receive a number of different trading perks which can significantly enhance your trading experience. These are all the currently available perks you can get through loyalty tokens:

- Free Evaluation

- 6% Profit Target

- 100% Profit Share

- 6% Daily Drawdown & 12% Total Drawdown

- 150% Challenge Fee Refund

- 200% Challenge Fee Refund

- 90% Profit Share

- 50% Discount

- 25% Discount

- 10% Discount

How BrightFunded Compares to Other Proprietary Trading Firms

Trading Instruments

In line with the rest of the prop trading space, BrightFunded is primarily focused on Forex trading, with over 40 currency pairs available to trade with, including majors, minors and exotics.

What sets the firm apart here is a large selection of crypto assets you can trade with, as the list is much higher than what most of the competitors have to offer today. In fact, there are currently 36 different cryptos you can trade on the website.

BrightFunded also allows trading in commodities like gold, silver and platinum, as well as natural gas and crude oil.

Finally, you can trade on indices like the S&P 500, Nasdaq 100 and others, completing an already impressive list of instruments available here.

Forex pairs can be traded with a leverage of 1:100, gold and commodities can be traded with a leverage of 1:40, while trading on indices has a leverage of 1:20, and 1:5 on crypto assets.

Commissions for forex, commodities, and crypto trades are also straightforward:

- Forex: $3 per lot

- Indices: Zero commission

- Crypto: 0.024% of trading volume

Spreads themselves are aggregated from multiple sources, and are competitive with many real brokerage accounts, though exact pips or basis points can vary.

Trading Platforms

BrightFunded currently allows traders to trade through the well-known DX Trade platform, often touted for its high level of customization options and user-friendly features, making it a great choice for both novice and experienced traders alike.

The firm also features the cTrader and MetaTrader 5 platform, which further enhances the overall trader experience, as these platforms are considered as probably the most feature-complete options on the market today.

Customer Experience

BrightFunded matches most other trading firms in terms of the overall quality of user experience. The website is extremely easy to navigate, and is full of educational content, while the company also regularly publishes long-form video guides and interviews on YouTube.

The customer support is available 24/7, via email, live chat or WhatsApp, and there is also an official Discord server with thousands of members sharing tips and best practices.

BrightFunded currently holds a 4.6/5 rating on Trustpilot, with most users praising the responsiveness of customer support and fast payouts, which are one of the firm’s main points of pride, as the average processing time here is just 4 hours.

A few negative comments typically arise from strict enforcement of trading rules, but the company’s transparency around these rules is generally consistent with industry standards.

The only real issue we have is a lack of a free trial option, especially since all of the actual trading is done on a platform that no new user has used before.

Our Verdict

Ultimately, BrightFunded’s blend of flexibility, potentially infinite scaling, and a fully hand-crafted trading environment sets it apart from its competitors.

With a variety of account options to choose from, fair trading rules and a fantastic loyalty program, this is a great choice for active traders looking to prove and hone their skills while potentially earning some of the highest profit splits on the market today.