Trading isn’t hard because of the markets, it’s hard because most traders rely on opinions, lagging indicators, or gut feelings instead of real data. That leads to the same pain points over and over: chasing trades, second-guessing good setups, and blowing accounts when fear or greed takes over.

Edgeful flips that equation. Instead of guessing, you get concrete probabilities built from raw market data. Instead of being paralyzed by trading psychology, you see exactly how setups perform in different conditions. What used to be an institutional advantage - processing millions of data points into actionable strategies - is now available on your screen.

With over 100 custom reports, live screeners, customizable dashboards, automated trading algos, and direct integration with TradingView and NinjaTrader, edgeful is built to eliminate the guesswork that wrecks most traders.

Annual pricing $39/month for a total of $486/year

Fortunly Rating

Fortunly's Rating: Our editorial team determines the rating based on a set of evaluation criteria developed for each product and service category.

- Deep data analysis

- Customizable reports

- Custom report types available

- Web-based

- Strong community support

- Steep price for algos

- Complex to use

- For more advanced day traders

edgeful’s Core Features

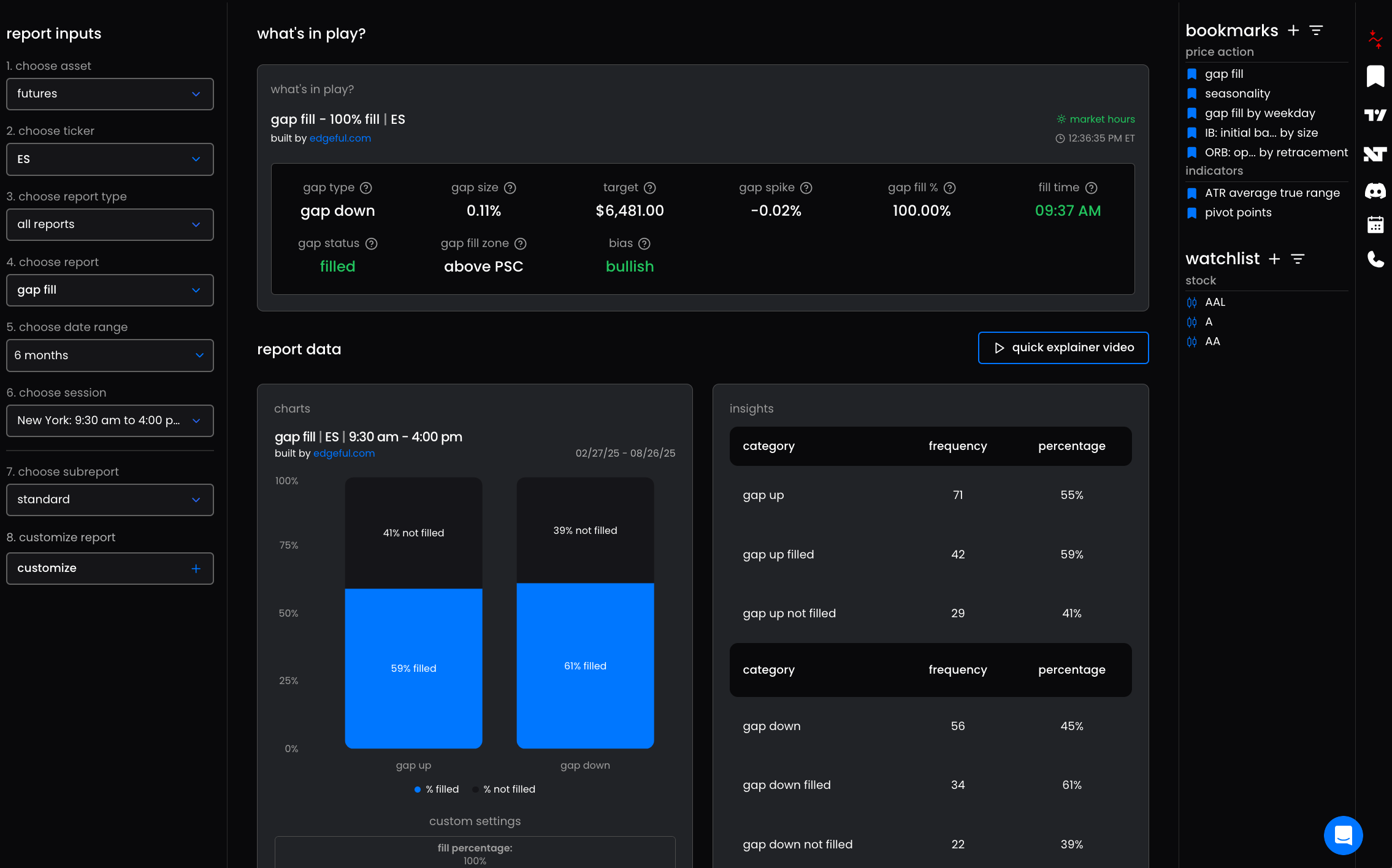

Most traders know the feeling: you see a clean setup, but you hesitate, you hold too long, or you exit too early. The problem isn’t just strategy, it’s lack of confidence in the numbers behind it. Edgeful’s reports fix that by showing exactly how price behaves, across thousands of historical cases, so you can make decisions based on probabilities instead of emotions.

These reports break down the patterns that matter most: what happens after a gap, how often the opening range breaks one side of the range, both sides, and neither side, which weekdays trend or chop, and where reversals are most likely to play out. Each one turns raw price action into a probability you can trust.

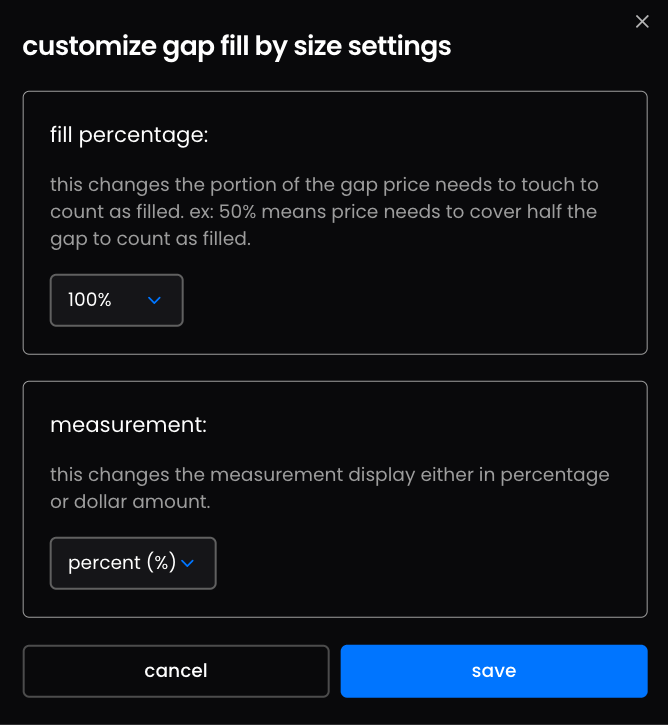

Customizing Your Reports

Edgeful gives you more than 100 reports, covering everything from gap fills, opening range breakouts (ORB), initial balance breakouts (IB) and more. Every report is customizable. You can filter by size, weekday, levels, date range, session, and more. This isn’t a handful of presets - you can shape the data to match your exact trading style.

If the report you need doesn’t exist, edgeful will build it. That’s a major pain point solved for traders tired of platforms that box them in.

Edgeful also pulls data directly from exchange feeds like Nasdaq, CME, Coinbase, and OANDA. No lag, no third-party distortion - just clean, accurate data.

What’s In Play

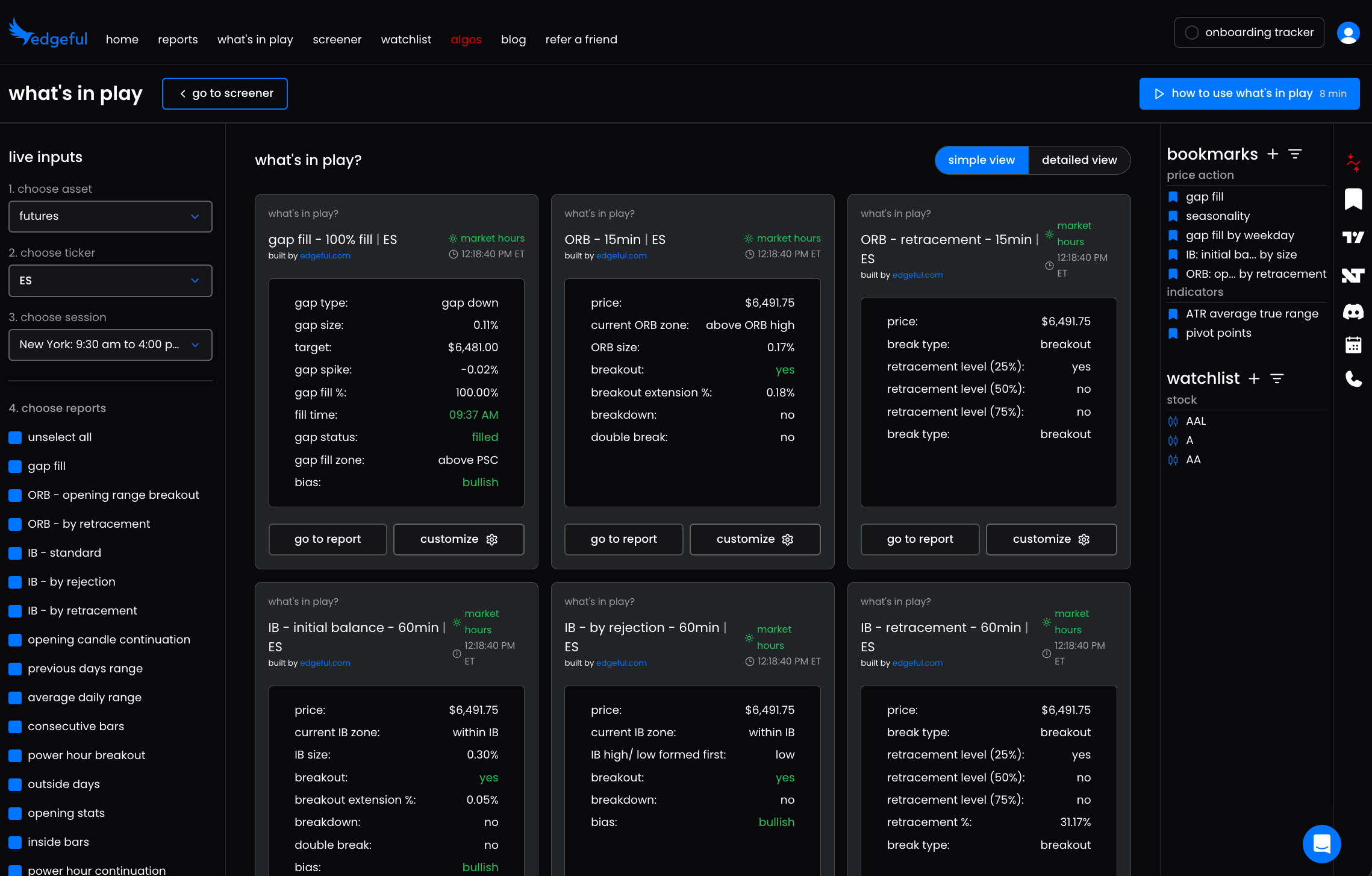

Traders often waste time hunting for setups across charts. What’s In Play solves that by showing you which strategies are playing out in real time so you can focus on high probability setups. In this dashboard, you can see current price, distance to target, directional bias, and key levels - all pulled directly from your chosen reports.

The dashboard is fully customizable, you can bookmark your favorite reports, build watchlists and switch setups with one click. It evolves with you, keeping the focus on execution instead of searching.

edgeful’s Screener

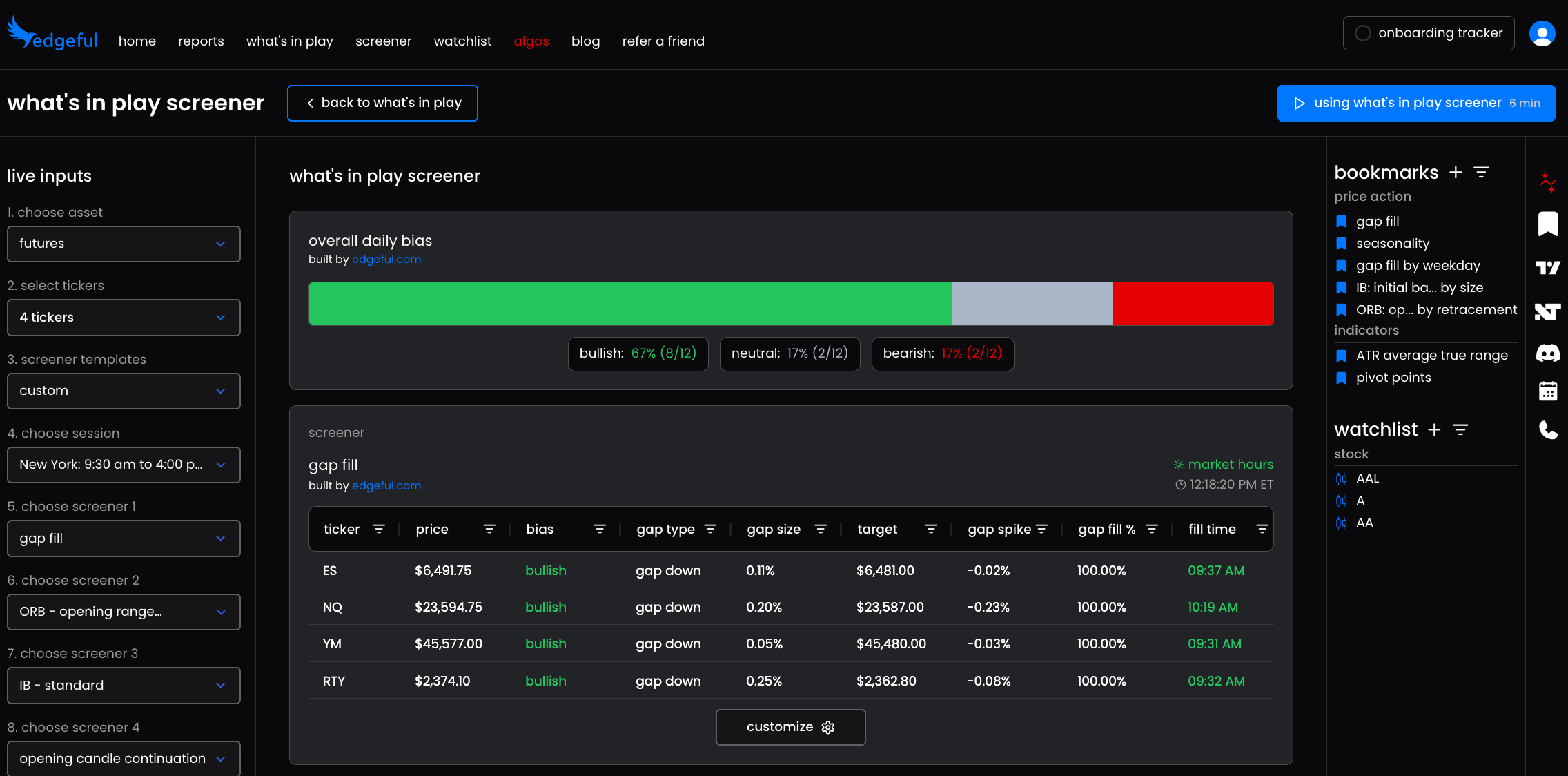

Every trader struggles with conflicting signals. The Screener cuts through that noise by aggregating multiple reports across your tickers in real time. You can line up four reports side by side - gap fill, IB, ORB, ADR - and instantly see where biases align or diverge.

This solves another pain point: knowing when not to trade. If your reports don’t confirm a clear bias, you know it’s time to stay patient instead of forcing trades.

Free Indicators For TradingView And NinjaTrader

Instead of drawing levels manually - and getting them wrong - edgeful gives you 35+ custom indicators that automatically plot key zones: gaps, sessions, pivots, IB/ORB ranges, and more. They’re fully customizable, so your charts match your exact definitions and strategy. This saves time and eliminates human error.

Automated Algos

For traders who want fully automated trading, edgeful offers customizable algos based on its core reports: gap fill, ORB, and engulfing candles. These algos handle entries, stops, and targets exactly as defined, removing hesitation and impulse. No coding required.

Edgeful’s algos integrate with Tradovate and NinjaTrader. You can connect your broker by following the step-by-step guide within the dashboard.

An upgrade is required to access the algos. Algo membership is $299/month and includes the base edgeful membership.

Community And Mentorship

Trading is isolating when you’re doing it alone. Edgeful’s Discord community solves that with shared settings, strategies, and daily discussions. You also get livestreams, CEO Q&As, private rooms for algo users, mentorship calls, and an extensive YouTube library of resources. The support network keeps you grounded and accountable - something most traders lack.

You can join their free discord here: https://discord.gg/fxakwREUtg

edgeful AI (Coming Soon)

Most traders don’t fail because they lack tools - they fail because they can’t get answers fast enough. Edgeful AI is being built to solve exactly that problem.

Instead of sifting through dozens of reports or waiting for someone else’s analysis, you’ll be able to ask direct questions about the market “how often does NQ fill a 0.5% gap on Mondays?" or “how often has ES broken one side of the initial balance by 20% and reversed to touch the other side of the IB in the past year?” and get instant answers pulled from edgeful’s full database.

Edgeful AI will also let you build custom reports on the fly. No coding, no spreadsheets, no waiting, just clear, data-backed insights created in seconds, tailored to the exact setups you care about.

This means less time searching and more time trading with confidence - turning raw market data into the probabilities you need, right when you need them.

edgeful Dashboards - A Deeper Overview

Edgeful packs in a lot of functionality, but the dashboards are designed to simplify, not overwhelm.

edgeful’s Reports Tool

Reports let you standardize setups across multiple markets and compare them at scale. You can break down ORBs by size, by weekday, by retracement, track IB by rejection, by levels and so much more. The customization ensures your strategies are consistent - solving the problem of “winging it” with new rules every day.

Oh - and if you need something custom, edgeful will build it for you.

Here is a preview of the types of reports they offer:

|

|

Live Context With What’s In Play

Missing a move because you weren’t watching the right ticker at the right time can be infuriating. What’s In Play keeps the highest-probability setups in front of you at all times, updating live with an overall market bias, distance to target, and performance tracking. It keeps you focused on execution instead of chasing noise.

Defining Daily Bias With The Screener

The Screener solves a major pain point: waking up not knowing which direction to lean. By combining multiple reports, you can confirm bias before the open, or step aside if the data isn’t clear. No more guessing, no more forcing trades.

Automation Through Algos

Many traders fail not because their setups are bad, but because they can’t execute them consistently, emotions get in the way. Edgeful’s algos solve that by automating entries, stops, and targets - enforcing discipline and eliminating hesitation.

How Automated Trading With edgeful Works

This isn’t theory anymore - edgeful’s automation is live, and it’s as simple as three steps:

- Connect your broker – Log into edgeful, agree to the terms, and connect your account. Setup takes just a couple of minutes.

- Create your strategy – Choose an algo (ORB, IB, Gap Fill, or Engulfing Candles), give it a name, and lock in your risk settings: stop loss, profit targets, weekday filters, and contract size.

- Link TradingView alerts – Grab your unique webhook URL from edgeful, paste it into TradingView when creating your alert, and use the provided template message.

Once an alert triggers, the algo fires your trade straight to your broker. Every order follows your exact plan: entries, stops, and targets - no hesitation, no emotions, just execution.

Right now, all trades run as market orders (limit orders are on the roadmap). And edgeful only manages positions it opens, so manual trades won’t interfere.

And here’s the key: Every trader is required to start in a paper account. This rule is non-negotiable. You test, refine, and confirm your setup in demo mode before going live. It’s the safest way to see how your exact parameters perform in real-time without risking capital.

edgeful For Futures Traders

Futures trading demands split-second decisions. One hesitation can mean a blown setup. Edgeful’s reports solve this by giving futures traders exact probabilities based on market history. Instead of outdated spreadsheets, you see real-time data: for example, how often does YM fill 90% of a gap, and how to size risk accordingly.

Pricing

For $49/month, edgeful gives you full access to its reports, screeners, dashboards, indicators, community, and mentorship. Annual plans lower the cost even further to $39/month for a total of $486/year.

For an additional $299/month, you can add the algo automation and trade without emotions.

Compared to the cost of missed opportunities or blown accounts, this pricing is minimal.

Bottom Line

Trading without data is gambling. Edgeful solves the biggest pain points traders face: guessing, emotional mistakes, lack of discipline, and reliance on opinions instead of facts.

With over 100 reports, live dashboards, customizable indicators, mentorship, algo automations and soon AI integration, edgeful gives traders what they’ve been missing: confidence in the numbers, clarity in the setups, and consistency in execution.