Founded in 2023 by Stan G., an industry veteran with years of Wall Street experience, Funding Traders is a prop trading firm that aims to empower future traders by giving them access to the capital necessary for success.

In addition to funds, Funding Traders provides traders with state-of-the-art tools, necessary knowledge and education, and a strong supportive community that promises to take traders to the next level.

One-time refundable fee.

Fortunly Rating

Fortunly's Rating: Our editorial team determines the rating based on a set of evaluation criteria developed for each product and service category.

- Wide assortment of plans and pricing options

- One-time refundable fee

- Comprehensive knowledge library

- Community support

- Top-notch customer service

- News trading allowed

- Only two payment methods

How Funding Traders Works

Funding Traders is a proprietary trading firm, meaning that they provide their traders with capital to trade with while in return traders share their profit with the firm.

Apart from capital, Funding Traders empowers traders by providing them with the knowledge and tools necessary for trading as well as access to a community of trading enthusiasts.

The benefit is mutual: the prospective trader receives high profits from the company's capital, while the company gets to employ a skillful and knowledgeable trader.

Funding Traders focuses on the foreign exchange market and provides traders with tools for leveraging expertise and risk management, all while promising a high-profit return for the trader and a low cost of trading.

Evaluation and Challenges

After signing up, you will have to complete one of their challenges in order to prove themselves as valuable candidates and show their trading strategies.

Traders that apply for any standard challenge account must profit 10% without going below 5-10% of their account size during the evaluation phase.

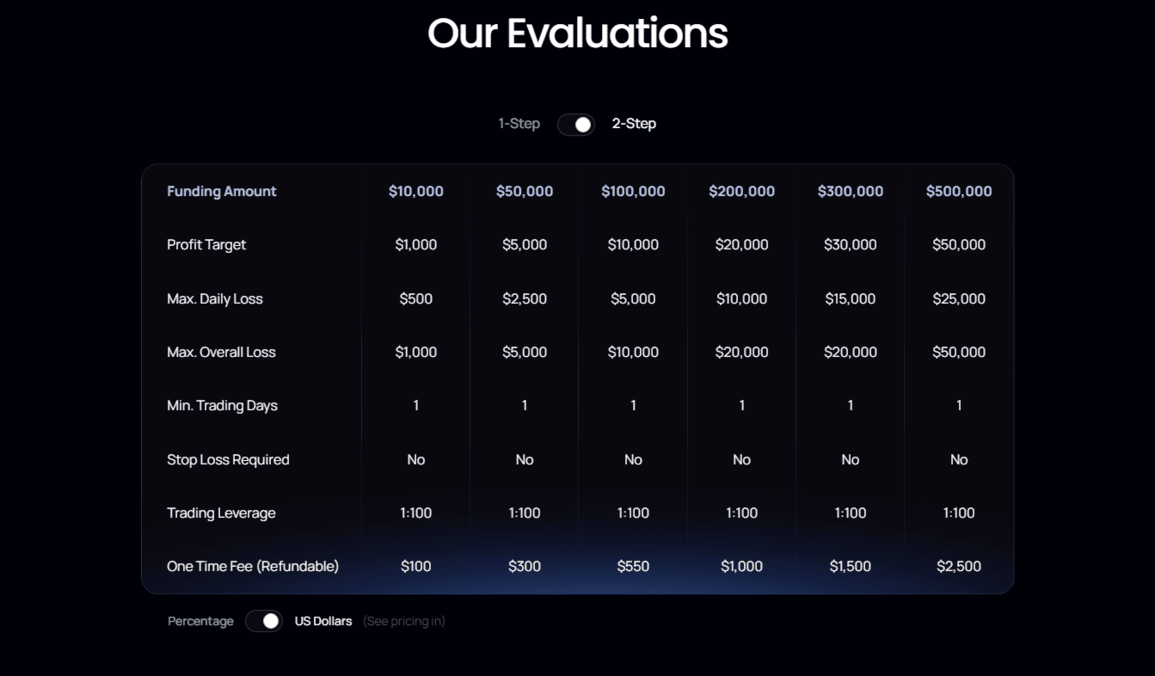

Funding Traders offers two types of challenges: 1-step and 2-step challenges.

Subscribers that choose a 1-step regular challenge have a 10% goal to meet with a 4% daily drawdown and 5% overall drawdown, trailing on the highest balance.

On the other hand, 2-step candidates, as the name suggests, have 2 phases to complete before getting funded. Phase 1 entails a 10% target, while phase 2 requires a 5% target to be met.

Drawdowns are a bit higher when compared to a 1-step challenge with the daily drawdown being 5%, while the overall drawdown is 10%, static on balance. Drawdown is reset at the end of each day.

Note that both challenges will allow you to withdraw after 7-14 calendar days, depending on your preferred funding method.

Pricing

Funding Traders sets itself apart from the rest of the competition with a wide assortment of trading accounts for soon-to-be traders. There are 6 regular account sizes depending on the amount traders are ready to invest.

The most basic plan, called Beginner, requires a $50 entrance fee with $5,000 funded. The most expensive account size "Superior" will grant you $200,000 in funds but comes with a steep fee of $1,000.

Note that this account plan along with the "Advanced" one will also grant you access to the weekly market prep webinar.

For more serious traders who want to dive in head-on and prove themselves, Funding Traders has 4 premium plans in stock.

The most affordable one is Expert which will net you $300,000 in funding with an entrance fee of $1,500. It also comes with a Weekly market prep Webinar and Quarterly trade review call.

On the other side of the spectrum, Funding Traders has an Apex plan. The entrance fee for this evaluation process is $10,000 which will secure you $2,000,000 in funding. Apart from the two features already mentioned in the Expert plan, traders will also have access to a 30-minute discovery call and 25-50 trades.

Traders that choose Elite and Apex plans will first have to complete an interview with Funding Traders' CEO Stan G. and a 2-phase challenge process to show their trading style and prove that they're a good fit for this challenging trader program.

Phase 1 has a profit target of 10%, the daily maximum loss is capped at 5%, while the maximum overall loss is 10%. The minimum trading period is 2 months, while the maximum is 6 months. Phase 2 is similar in all the specs except for the profit target which is 5%.

Additional Important Rules

Funding Traders allows traders to trade new events and hold positions overnight or over weekends. The first payout will be available 7-14 days after the first trade was placed on the account, and every subsequent payout will be available in the next 7-14 days.

Funding Traders' default split is capped at 80% for the trader. traders are allowed to increase that percentage to 100% after buying add-ons to their funded account.

What sets Funding Traders apart from other proprietary trading firms is that they offer a scaling plan of 25% growth every 3 months in which traders achieve 10% profit at the end of said period.

The current max allocation is capped at $750,000 per customer, but, for the advanced plans, Funding Traders allows maximum account scaling up to $2,000,000. It's also possible to merge accounts just by sending them an email with specifics of the accounts you want to be merged.

One of the main restrictions is that glitches or high-frequency trading are not allowed.

Funding Traders use FXCH as their primary liquidity provider and trading platform. As for the assets, traders can trade forex, indices, stocks, metals, and even dabble in crypto trading.

Payout Methods

There are two payout methods to choose from: bank transfer or cryptocurrency. Traders that prefer bank transfers will have to set up a Deel account as an independent contractor and connect it to their bank account.

The waiting period for bank transfers is 1-5 business days.

The cryptocurrency method is reserved for traders that aren't situated in Deel's allowed countries, and the transfer of funds is instant.

How Funding Traders Compares to Other Prop Firms

Forex, Indices, Stocks, Metals, Crypto

100%

Up to 1:100

From $50

Forex, Metals, Indices

Up to 100%

Up to 1:100

From $39

Futures

100% on the first $30,000 and then 90%

Up to 1:100

From $35

Customer Support and User Satisfaction

If you encounter any issues or have questions in general, you can reach their customer support via live chat, contact form, Twitter account, discord, or email address [email protected].

Alternatively, you can find an answer in their comprehensive FAQ section. We tested out their live chat team and they were very attentive and fast to respond.

At the time of writing this review, the company had a 4.9/5 score on TrustPilot based on more than 200 reviews.

Customers praise their payout policy, a strong and helpful community of expert advisors, customer support, and their innovative approach to prop trading.

Final Verdict

Funding Traders is probably one of the better prop trading firms out there when it comes to the assortment of plans for future traders.

They offer traders to choose between 10 different programs depending on the funds traded and the fee. In addition to that, they provide traders with a decent variety of trading assets, help from experienced professional traders, and access to a rich knowledge hub.

If you're a successful forex trader, you can also up the ante by applying for a 25% growth scaling plan.

Couple that with excellent customer support and speedy withdrawals, and Funding Traders proves as an excellent choice both for beginners and veteran traders.