Liberty Market Investments (LMI) is a London-based proprietary trading firm. Founded in 2018, the company aims to provide transparent recruitment programs for beginner and professional futures traders alike and to help everyone grow their trading skills in order to apply them in the global financial markets the best way.

No one-time evaluation fees.

Fortunly Rating

Fortunly's Rating: Our editorial team determines the rating based on a set of evaluation criteria developed for each product and service category.

- High profit split offer

- No hidden fees or costs

- 14-day free trial

- Users have free access to the VolFix platform

- Wealth of educational materials and tools

- Built-in risk management system

- Only futures trading allowed

Liberty Market Investment Overview

The LMI company is owned and operated by Liberty Market Investment ltd, based in London, United Kingdom.

The company was built around the idea of providing a transparent and competitive prop trading service for futures traders of all experience levels, offering a great support structure and industry-leading profit splits to traders around the world.

Evaluation Program

The evaluation program structure is immediately different from that of most of the companies on the market.

While other firms mostly stick to a two-step evaluation process, LMI switched to a 1-Stage evaluation approach, meaning that you can get to a funded account much quicker.

The 1-Stage evaluation process called the Qualifying Pro Session is based all around the Consistency Target rule.

This means that in order to qualify, you will have to show a constant profit growth in your account, learn how to operate with risk and avoid having your best day profit reach 50% or more, in which case you will need to keep trading until the best day percentage of your total profit is below that 50% threshold.

The initial rule values for the Qualifying Pro evaluation are:

|

Account Size |

Profit Target |

Best Day Profit (Consistency Target) |

|

|

$50,000 |

$3,000 |

Less than $1,530 |

|

|

$100,000 |

$6,000 |

Less than $3,060 |

|

|

$150,000 |

$9,000 |

Less than $4,590 |

|

If your best day profit becomes more than 51% (or 52% for the Mini account) of the current target profit, a new profit target will be calculated. For example, if you opt for a $50,000 account, and your best day profit goes above the $1,530 consistency target to let’s say $2,000, the new calculated profit target will be $2,000 / 0.51 = $3,921.56.

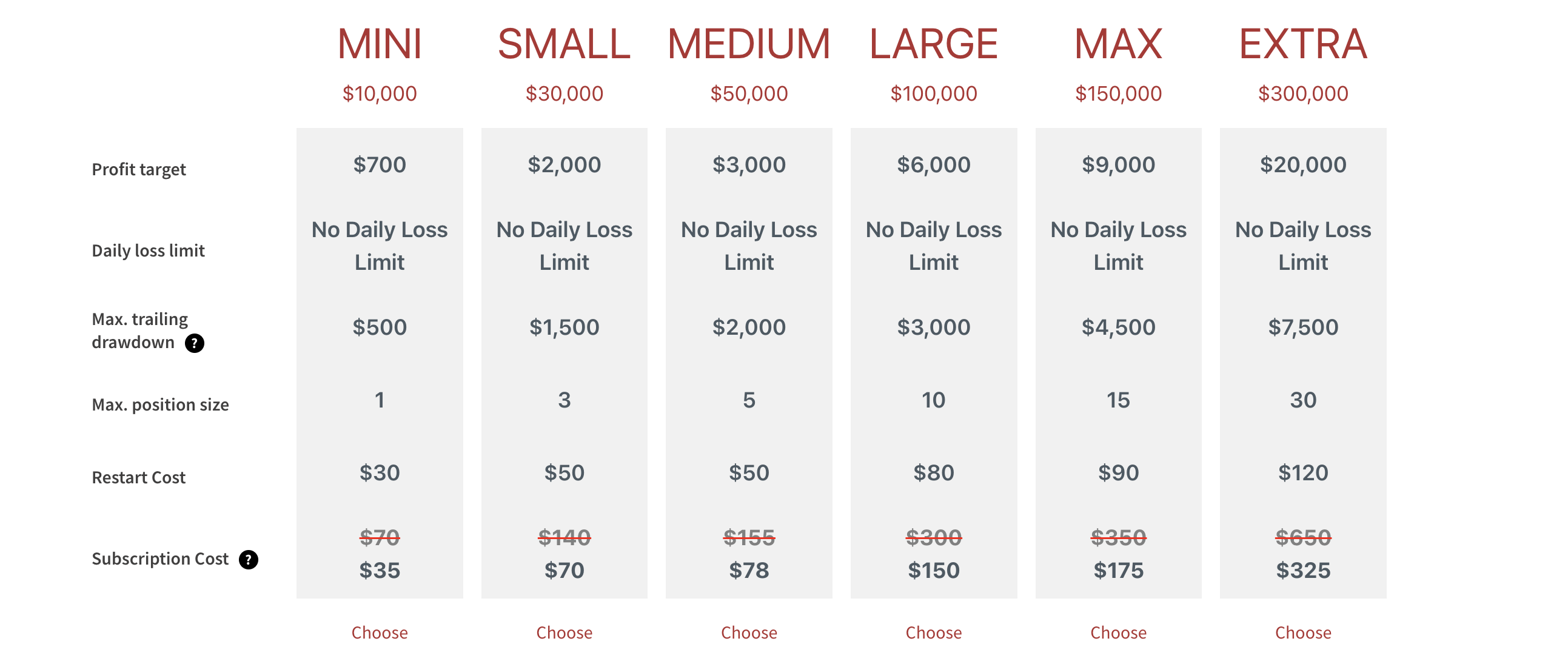

There are no time limits on completing evaluation process, other than the need to extend your 30 day subscription if you don’t achieve the goal before that, and if you’ve broken any of the rules, you can restart the evaluation stage for as little as $50, depending on your plan.

Subscription costs start at $35/month for the Qualifying Pro Mini plan, and go up to $325/month for the Extra plan with $300,000 in account size and a $20,000 profit target.

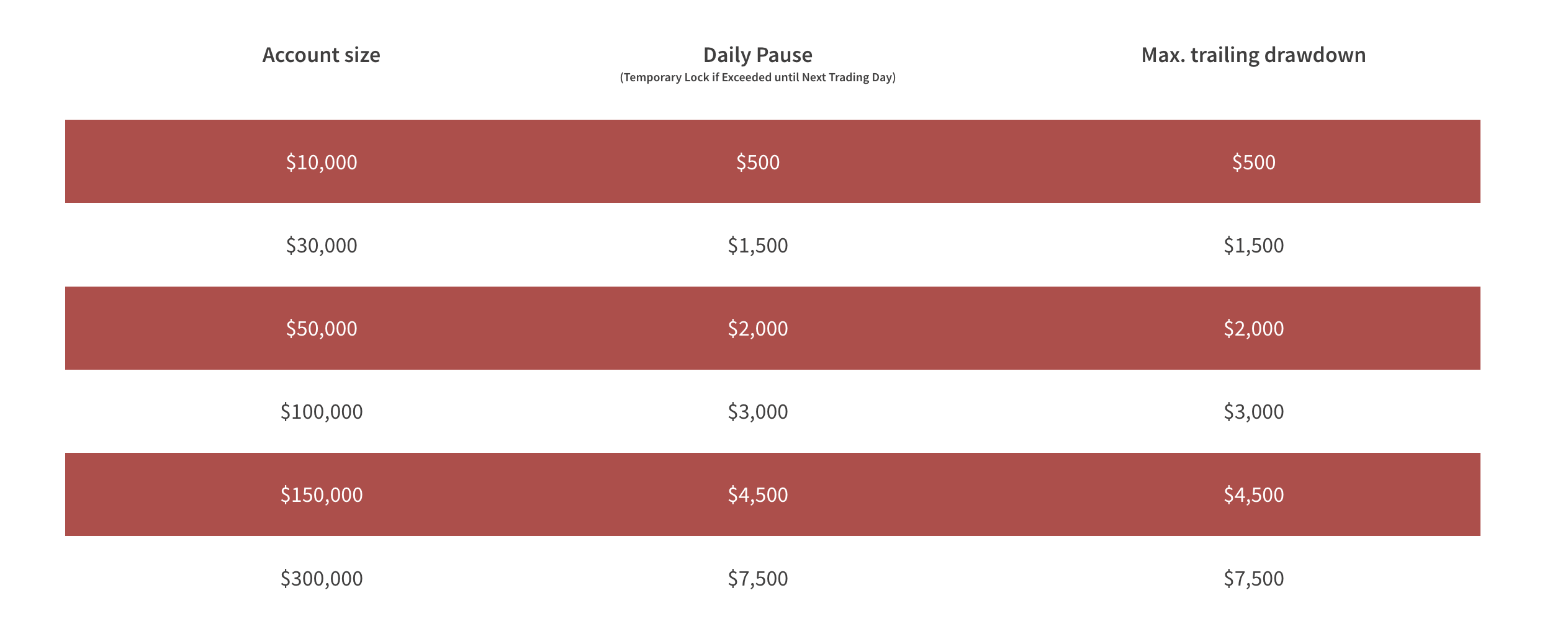

There are no daily loss limit rules, but you have to respect the Maximum trailing drawdown rules, meaning that your account balance must not go below the stated threshold at any time.

Funded Account

Once you’ve passed the evaluation process and prove that you can manage risk and investor capital, you will move to the final stage, called the Funded Session.

Note that sometimes you’ll have to wait for a day or two in order to get your contract papers and account details and be ready to trade with a funded account.

The LMI Funded Session account features one of the better offers we’ve encountered so far, with 100% of all withdrawals up to a total of $30,000 going to the trader, after which the profit split becomes 90/10, and funded traders earn 90% of all future profits.

LMI has also recently introduced the feature of allowing all funded traders the ability to operate up to three different Funded Session accounts at the same time.

All withdrawals are made through Deel, which offers various withdrawal methods, depending on your region. You can withdraw your profits via bank transfers, PayPal, Payoneer, Binance, Revolut, Coinbase, Wise or through the Deel Card and the Deel Instant Card Transfer.

In terms of fees for a funded account, you will have to pay a monthly exchange fee directly from the account balance.

For example, the Futures exchange costs $13/month, while the EUREX exchange fee is set at €20/month.

The company also recently introduced a Consistency Target rule to its funded accounts, with a 30% consistency target, which is now one of the requirements for withdrawal requests. After each withdrawal you make, the consistency target will be reset once again and calculated using trades made after your withdrawal request is completed.

The Funded Session account now also features an increased daily loss limit, which matches the trailing drawdown level of your chosen account size. With this change, you'll now have more flexibility and control than ever before when trading through LMI.

Trading Platforms & Instruments

All trading on LMI goes exclusively through the well-known VolFix trading platform, which is one of the only notable downsides we can point out, simply due to the fact that there are some prop firms on the market which provide a wider choice to their traders, and feature more popular and widespread platforms like MetaTrader5.

However, due to the connection between Volfix and LMI, the most reliable execution and technical capabilities are provided to the client, which are not usually available with other prop companies.

The Volfix platform was created in 2006 and is designed for volume analysis. With Volfix you will have the key to understanding all market processes, and the ability to analyze and interpret trading volume will put you on a par with professional traders.

You can access the VolFix platform on all of the world’s biggest operating systems, such as Windows, MacOS and Linux, as well as through both Android and iOS mobile apps.

The platform itself is minimalistic and fairly easy to use, featuring a built-in risk management system and a great deal of customizability, allowing you to tailor the platform to your personal trading needs.

For example, you can see a chart trading interface we’ve used below.

VolFix also has a built-in LMI Trade Report feature, accessed through the “Component” button on the Market Watch window you can see above.

In the LMI Trade Report, you can track your trading statistics and all the historical data regarding your successes or rule breaks, making it easier to adjust or improve your strategy.

In terms of instruments, LMI offers a large selection of future markets to trade with on the VolFix platform.

You can trade in equities, cryptocurrencies, forex, agricultural and interest rate futures, on a number of different US and EUREX exchanges.

Liberty Market Investment users can also take part in VolFix traders’ competitions, which are completely free to join and are designed to further improve your trading skills.

The prizes for winners include free Practice Session accounts and Traders’ Recruitment Program discounts, with the prizes going to the trader who gets maximum profit at the end of a competition.

How LMI Compares to Other Prop Trading Firms

Futures

From $35

100% on first $30,000 and then 90%

Futures

From $149

100% on first $10,000 and then 90%

Forex, Cryptocurrencies, Indices

From $95

Up to 85%

Customer Support & Satisfaction

LMI has a dedicated customer support team which can be reached through email or Skype, and provides a wealth of educational and helpful content on their platform, making it extremely easy to find an answer to any question that you may have.

Customers themselves have a positive overall rating of the platform, as LMI has a 4.1-star rating on TrustPilot and a 5-star rating on Facebook.

Our Verdict

All in all, Liberty Market Investment represents a solid choice for prop traders of all experience levels, even though we recommend it more to traders with previous trading history and knowledge of the industry.

With one of the best profit split offers on the market and a highly specialized and customizable futures trading platform, it is a great choice for those traders that can take the full advantage of what LMI has to offer.