A relative newcomer in the proprietary trading space, PipFarm was established in 2023 with the aim of bridging the gap between traders and institutional capital.

With a flexible evaluation process, a variety of advanced trading tools and one of the highest profit splits on the market, it certainly deserves a closer look from any aspiring trader out there.

Up to 95% profit split.

Fortunly Rating

Fortunly's Rating: Our editorial team determines the rating based on a set of evaluation criteria developed for each product and service category.

- Only requires one-time fees

- Payout protection feature

- Uses cTrader platform

- Very high profit split

- Up to $1.5 million in trading capital with the Scaling plan

- Allows news and weekend trading

- Innovative lifetime loyalty system

- No withdrawal fees

- No upgrades or add-ons sold

- Currently doesn’t provide ETF or stock trading

- Strict daily drawdown rules

- Few educational resources

PipFarm Overview

PipFarm is operated by ECI Ventures Pte. Ltd., and the company’s headquarters is in Singapore.

It is a simulated trading evaluation firm, mainly focused on Forex trading, even though it offers a substantial list of other instruments that you can trade with.

Like other prop trading firms, the company’s goal is to find, evaluate and ultimately fund talented traders, giving them access to institutional capital and substantially reducing personal trading risk.

The company’s innovative experience-based progression system and a scaling plan that can provide you access to up to $1.5 million in trading funds make it one of the most exciting new names and a worthy competitor in a highly contested market.

Evaluation Process

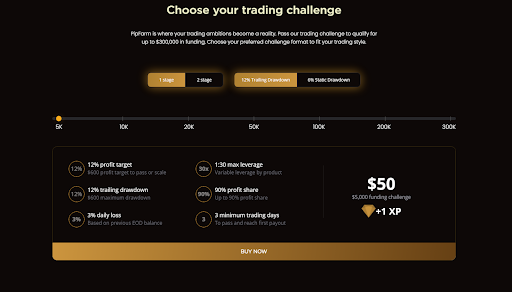

PipFarm offers a flexible evaluation system, catering to various trading styles.

You can opt in for a one-stage evaluation by choosing to go with either a 12% Trailing Drawdown or a 6% Static Drawdown, or you can opt for a two-stage evaluation with a 9% Static Drawdown, but with a much lower profit target.

In the one-stage evaluation, the profit target is set at 12% for both of the available choices, while the two-stage evaluation has a 6% profit target.

This means that if you opt for a $5,000 account and one of the one-stage evaluation programs, you would have to generate a $600 profit.

During the process, you must adhere to the firm’s risk management rules, most notably by making sure that your daily loss limit doesn’t exceed a tight 3% (calculated based on the previous day’s end-of-day balance) set by PipFirm.

If you break any of the risk management rules, you will be disqualified and be required to start the challenge anew.

The same goes for the two-step evaluation program, but it has a more gradual process, where you must meet the profit target with a 9% static drawdown for two times in a row, by following all the same risk management rules.

A minimum of 3 trading days is required in all challenges, and all traders are provided 1:30 leverage, though this can vary depending on the instrument being traded.

If you succeed in passing the challenge, you will start trading with a 70% profit share, which can be further increased to 95% by gaining experience and leveling through the firm’s innovative XP system, in which you rank up based on your performance and by doing so earn additional perks.

The evaluation fees are one-time charges, ranging from $50 to $1,550 depending on the size of the account being evaluated.

How PipFarm Compares to Other Prop Trading Firms

The Scaling Program

PipFarm’s scaling program stands out among the competition, as it allows you to potentially grow your funded account up to a maximum of $1.5 million.

You can do this over time, by hitting the 12% profit target every 30 days, which will in turn expand your funded account size by 50%. There are no additional evaluations or tests, you are just required to show consistent performance.

Each funded account can be scaled up to four times, capping at a 300% increase of the initial seed funding.

What makes PipFarm’s program great is the fact that you do not risk your existing profits in order to scale your account. Before each funding round, the profits are distributed and you are allowed to continue with the additional capital without compounding the risks, which ensures that you can increase your earning potential without risking your gains.

Trading Platforms

All trading is done through the cTrader platform, which is one of the most advanced trading platforms on the market, widely known for its trademarked Traders First approach, impressive selection of tools and an easy-to-learn interface.

With cTrader, you can employ various proprietary trading strategies, and you’ll have access to charting and risk management tools, along with a real-time news feed.

You can access your account on both the desktop and mobile devices, and PipFarm will allow you to use any trading style, excluding only high-frequency and copy trading.

Supported Trading Instruments

PipFarm is mostly focused on Forex trading, but it provides access to over a 100 different instruments, including cryptocurrencies, indices and commodities.

Some of the instruments you can trade with are:

- Forex: Major, minor, and exotic pairs like EUR/USD, GBP/JPY, and AUD/CHF.

- Commodities: Precious metals like XAU/USD, as well as energies like WTI and Brent crude oil.

- Cryptocurrencies: Popular digital assets such as Bitcoin, Ethereum and Ripple.

- Indices: Global indices including the S&P 500, FTSE 100 and DAX.

Payout Methods

PipFarm offers traders the ability to request payouts quickly and efficiently:

- First payout: Eligible after 3 trading days.

- Bi-weekly payouts: Available every 14 days after the initial payout.

- On-demand payouts: You can unlock faster payouts through the XP system, with potential withdrawal requirements reduced to as low as 1% of profits.

There are no payout fees, and you can use Rise, Skrill, Binance Pay and USDT to withdraw earnings from your account.

Customer Support and Satisfaction

PipFarm’s customer support is accessible through various channels. You can contact the firm through a live chat option available on the website, or you can reach out to the support staff by sending an email to: [email protected].

You can also get assistance through Discord, where PipFarm’s community boasts thousands of traders, or through a support channel on Telegram.

Where we would love to see some improvement is in the number of educational resources, as the company is currently lacking in this regard, having launched just over one year ago..

While PipFarm doesn’t have thousands of customer testimonials, the ones it does have are overwhelmingly positive. The company does hold an excellent 4.6/5 rating on Trustpilot, indicating an overall high level of user satisfaction. Traders mostly applauded the company’s fast payouts, fair business practices and proactive customer support.

Final Verdict

All things considered, PipFarm offers a high level of flexibility and scalability. The firm’s profit split rate is among the highest in the industry, and its scaling plan provides a solid, steady increase to successful traders.

And while the tight 3% daily drawdown rule and the lack of educational resources can be seen as drawbacks, the platform’s offerings are already quite robust and its trading fees among the lowest in the industry, making it a great choice for anyone seeking a clear and continuous path to capital growth.