Whether you are a beginner or an experienced trader, the ability to analyze, track and manage your trades often becomes overwhelming.

This is where Stock Market Guides comes in, with its proprietary scanning technology, built to identify specific market patterns that have shown historically profitable outcomes.

Our review will examine all of the company’s services and features, hopefully providing you with enough information to be able decide if it's the right choice for you.

43.1% average annualized return in backtests for stocks

Fortunly Rating

Fortunly's Rating: Our editorial team determines the rating based on a set of evaluation criteria developed for each product and service category.

- Proven backtested trade setups

- Easy-to-follow alerts for stocks and options

- Great annualized return potential

- Affordable pricing

- Highly customizable service

- Wealth of educational material

- No mobile app

Company Overview

Stock Market Guides was built by a team of trading experts with decades of experience and deep knowledge of market behaviours and statistical modeling.

What makes this platform stand out from other similar services is its focus on transparency and quantifiable metrics, as the proprietary scanner comes with historical performance data, providing traders with a clear overview of the statistical probability behind each trade idea.

Another big thing here is the fact that Stock Market Guides functions purely as a research and signal service and not as a trading platform, meaning that not only it allows you to maintain complete autonomy while benefiting from the company’s insights, but also does not require you to share any sensitive personal and financial data.

Core Services and Pricing

At the heart of Stock Market Guide’s offer is its aforementioned scanner, which you can use to either pick trades for you, or to analyze and research trade ideas with its assistance by yourself.

The scanner can be used for stock investing, swing trading and options trading, and each of the options available to traders comes at a different subscription cost.

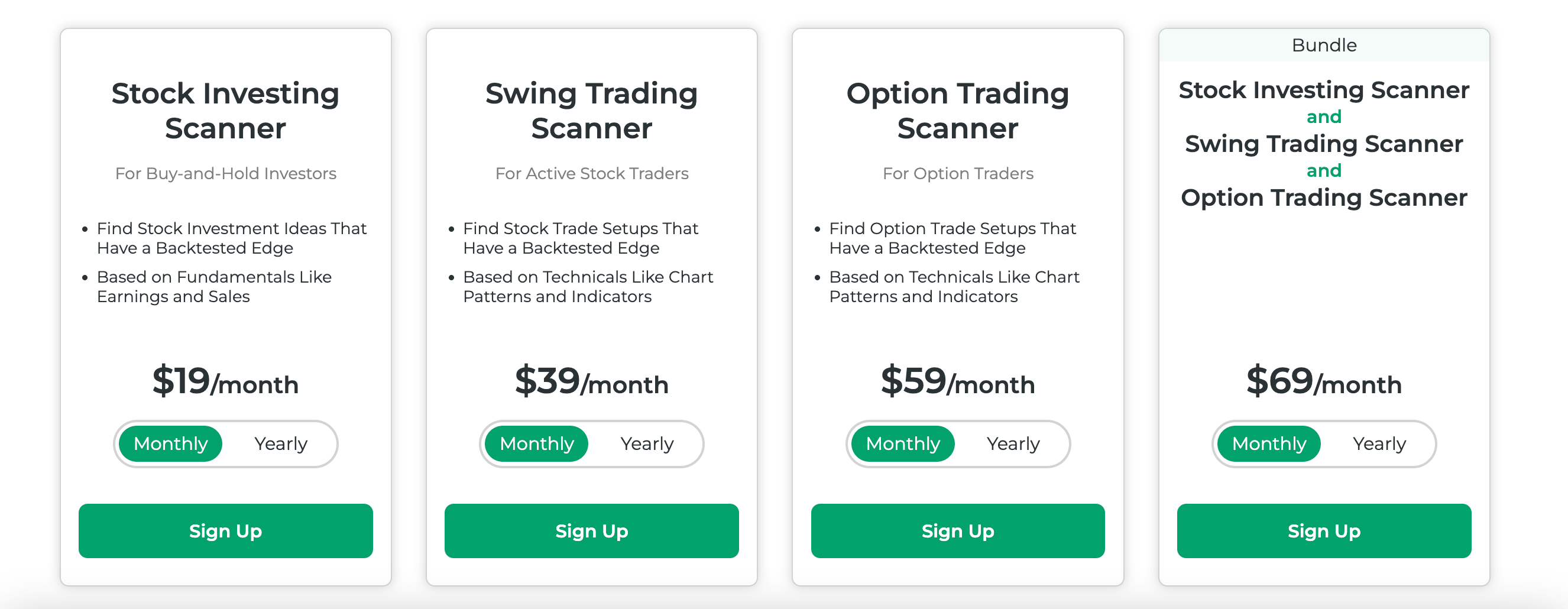

Scanner Offer

Let’s start by examining the features available to traders who want to use the scanner to do their own research.

The platform provides three core scanning services, each of which provide you with real-time alerts, either through email or text, and every result includes a complete trade setup, with both entry and exit rules included.

You can also see the back tested win rate and performance summary of each result, and evaluate the historical effectiveness before acting on any trade.

Showing the historical track record for each trade setup is what truly differentiates this service from others in the same space.

The Stock Investing Scanner is the cheapest option available on the platform at this moment, coming at $19 per month, or at around $12.41 per month with an annual plan.

This option is best suited for buy-and-hold investors, as it highlights stocks with strong fundamentals, and allows you to uncover investment opportunities that have overperformed over extended holding periods.

The Swing Trading Scanner is more suitable for active traders, as it identifies short and medium term setups by using chart patterns and momentum indicators, catering to traders that are looking for trades with holding periods of few days to several weeks. It comes at a monthly cost of $39, or $249 per year.

The Option Trading Scanner service targets option traders by scanning for setups based on both proprietary and popular strategies, leveraging indicators such as volume spikes, breakouts, and volatility patterns. This service costs $59 per month, or $475 with an annual plan.

Lastly, Stock Market Guides allows you to access all three of these services at the same time with its bundled plan, costing $69 per month (or $575 annually), which makes it a highly cost-effective choice here, provided you are trading on a multi-level approach.

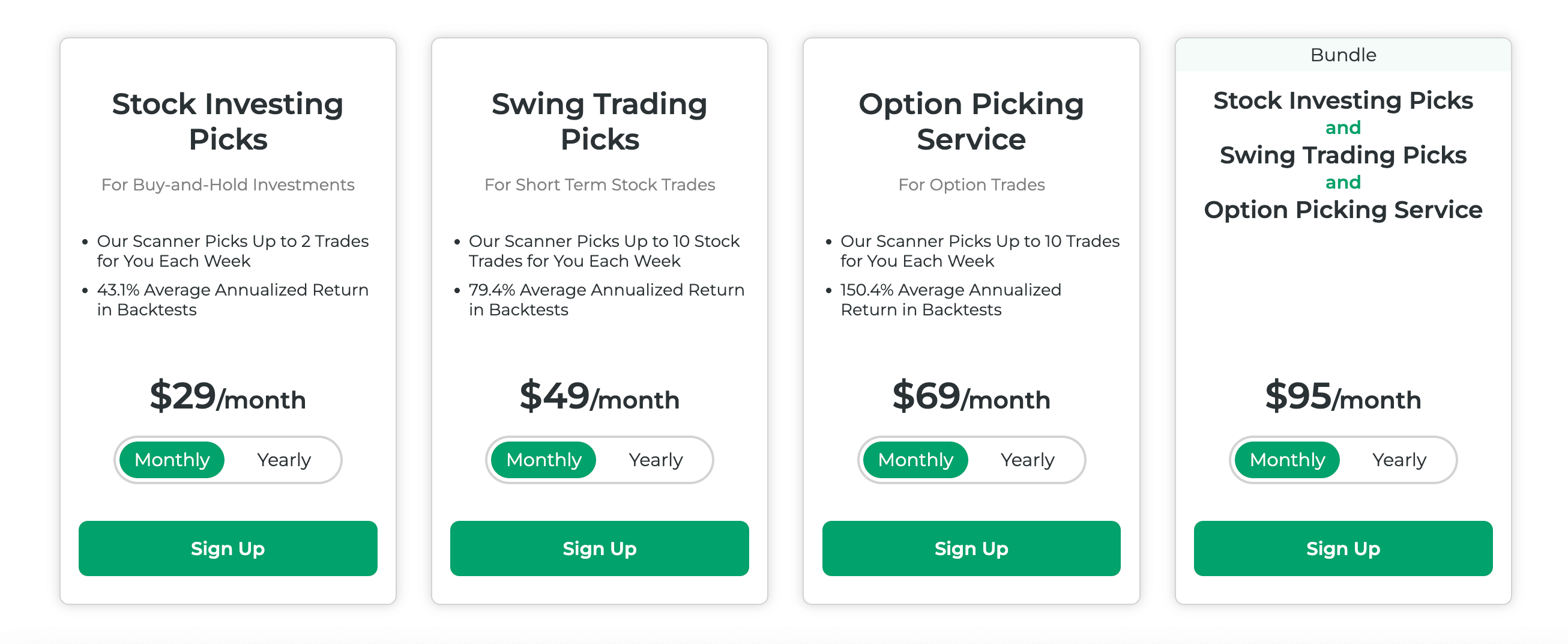

Stock Picking Offer

In addition to its scanner-based research tools, Stock Market Guides also offers a fully managed Stock Picking Service.

This part of the platform’s offering uses the same scanner technology but automates the process, delivering curated trade picks based on backtested performance metrics.

The Stock Investing Picks service is tailored for long-term investors.

The scanner selects up to two trades per week, focusing on stocks with strong fundamentals and proven long-term track records.

According to the company’s backtests, this service delivers an impressive average annualized return of 43.1%.

The monthly subscription cost for this service currently stands at $29 per month, or $240 per year for those choosing the annual plan.

The Swing Trading Picks service is ideal for more active traders, as it provides up to ten stock picks per week. The picks are based on technical patterns, momentum indicators and price action.

With an average backtested return of 79.4%, this plan costs $49 monthly or $399 annually.

The Option Picking Service is geared toward experienced traders interested in leveraged returns. It also delivers up to ten option trade alerts weekly, targeting high-probability setups based on technical and proprietary strategies.

With a striking 150.4% average annualized return in backtests, the service is priced at $69 per month, or $575 per year.

For those looking to maximize value and diversify across all strategies, the company once again offers a bundled plan that includes all three services for a combined price of $95 per month, or $799 annually.

Educational Material

Aside from its main services, Stock Market Guides also offers a very well-rounded educational experience, aimed at both experienced and novice traders.

For starters, the company has a great number of extremely detailed strategy tutorials that its scanner uses, explaining the logic behind the scanner, as well as clearly stating the entry and exit rules, which key indicators or fundamentals are involved, and how the scanner identifies opportunities.

New users also have access to a library of video tutorials, which can be highly useful in understanding all the crucial mechanics and processes associated with trading and risk management.

When it comes to managing risk, the platform also has built-in calculators, available across all the company’s services.

The Position Size calculator can help you determine how many shares or contracts to buy, based on account size, risk per trade and stop-loss distance, ensuring that your capital is allocated efficiently and without overexposure.

The Profit/Stop calculator, on the other hand, allows you to evaluate potential reward-to-risk ratios, calculate break even points, or determine the right stop-loss and target price levels for each of your trades.

Lastly, Stock Market Guides has a rich blog and glossary section on the website, with all the definitions, chart patterns and other important guides which are very useful for traders that are still mastering technical analysis.

Customer Experience and Support

Stock Market Guides is currently a pure web-based platform, meaning that there’s still no official mobile app available to users.

Still, we’ve had no problems navigating the platform on all devices, as it's created in such a way to be extremely easy to navigate, and the text/email alerts work well on smartphones.

The customer support service can only be reached via email, which is also something the company can improve upon in the future, but from our experience, the staff gets in contact quickly even without features like a live chat.

Final Verdict

Stock Market Guides stands out as a powerful yet affordable trade alert service for stock and options traders who want to remove the guesswork from their strategy.

With statistically-backed alerts, customizable tools, and transparent reporting, SMG empowers traders to make smarter decisions backed by data—not emotion.