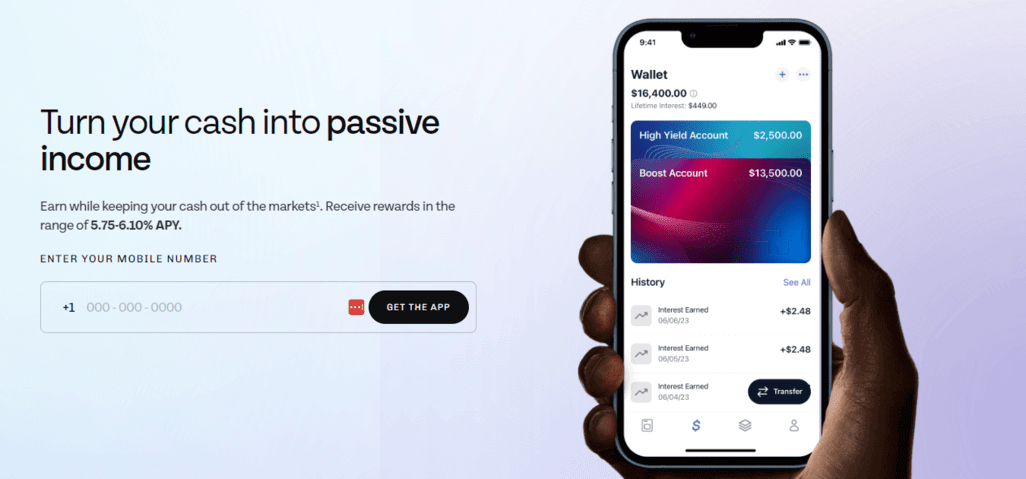

If you wish to turn your idle cash into a passive income stream, you should consider Tellus. This online fintech company has been making waves since 2016, and it offers high-yield cash management accounts and rental property management tools to make passive income a reality for everyone.

Monthly fee $0

Fortunly Rating

Fortunly's Rating: Our editorial team determines the rating based on a set of evaluation criteria developed for each product and service category.

- Base rate of 3.85% APY (6.00% possible for short durations)

- Up to 5.12% APY with Vaults

- Pays out 18 times more than the average savings account

- No fees

- Withdraw anytime

- Interest paid out daily

- No crypto or stock exposure

- Backed by US-based residential real estate

- Reliable US-based customer support

- Not FDIC-insured

- No brick-and-mortar locations

Tellus Overview

Tellus is a financial technology company founded in 2016 with the aim of unlocking the power and durability of real estate to make passive income accessible to everyone.

Along with its three main high-yield savings products, the company offers customizable subaccounts for smart budgeting, and comprehensive real-estate management tools for landlords and property managers.

Tellus is not a bank, which means it's not FDIC-insured. Instead, the company backs customer deposits with residential real estate pledged by the borrowers it lends to; the first of three ways in which the company protects your money (read more about Tellus’s Triple Layer Protection).

Banking services delivered on the platform are provided by Chase Bank, which is an FDIC member. Payment solutions are provided by Stripe and Plaid. Notably, Tellus closed its most recent funding round, led by a16z, at the end of 2021.

How Does Tellus Compare to Other Cash Management Accounts?

$0

5.75-6.10%

$0-$5.99/month

5%

$0

0.10%

Tellus Financial Products

Tellus offers two main cash management account products: Reserve Account and Boost Account. Both of these accounts are completely free to use, offer competitive interest rates, and let you withdraw your money anytime.

The latter allows you to earn a number of other rewards too.

Tellus is available for iPhone and Android smartphones. To start using Tellus, simply go to your app store, install the latest version of the app, and review the terms and conditions.

Signing up is a breeze and won’t impact your credit in any way.

Here’s a closer look at the features and benefits of each account.

Reserve Account

The Tellus Reserve Account is a high-yield cash management account that steps up your interest rate with a hands-off approach.

The only thing you’ll be required to do is deposit money and wait for it to grow; and with a 4.75% APY expect it to grow fast.

The company promises a stunning 22 times higher annual percentage yield than the average bank savings account when compared to the national average savings rate.

With the app, your cash is backed by prime US-based residential real estate. Your cash is never exposed to the volatility of the crypto or stock markets.

With the Tellus Reserve Account, you can count on a base 4.75% APY up to $2,500. However, once your balance reaches the limit, the interest you earn will be automatically deposited into your Boost account, which isn't capped.

The company recently launched features that enable you to increase your Reserve Account balance up to $4,000 by completing tasks in the app. Again, totally free.

If you want to make the whole process even easier, you can set up recurring transfers from your bank to automatically move money into your Reserve Account.

The Boost Account

The Tellus Boost Account is a top-rated high-yield cash management account that lets you earn daily compounding interest on your balance. This account offers a solid minimum 3.85% APY on all account balances, with no caps on how much you can deposit or earn.

But there's a neat twist - with free Daily Boost and Daily Trivia, you can earn as much as 6.00% APY for short durations. Tellus calls it “boosting.”

Boosts are essentially free interest rate bonuses that are available to unlock every day. You can earn them simply by logging into your account and claiming a free Boost. And since Tellus compounds your interest daily (instead of monthly, like many banks), that extra APY can add up.

With a Tellus Boost Account, you can sometimes get extended Boosts that can last for a week or even a month and require you to complete special tasks, such as referring a friend to Tellus or participating in one of monthly promotions.

You can also boost your APY by participating in Tellus's trivia game.

Simply answer a few questions correctly, and you'll earn a bonus that will be applied to your account balance.

Stacks

One of the great things about Tellus is that it offers users the ability to create an unlimited range of simple and customizable subaccounts that can be used to manage their finances.

These subaccounts are called Stacks, and they're like virtual piggy banks that make it easy for you to save money and reach specific financial goals.

The company lets you review your balance and transfer money to and from your Stacks to your main Boost Account at any time with just a few taps.

You can also set up a recurring deposit so that you automatically funnel money into your Stacks on a regular basis.

Your Boosts will automatically apply to your Stacks, too, so you can reach your savings goals quickly and easily.

Vaults

If you have the luxury of locking up your funds for a fixed period, you should try the Vaults cash account. With it, you can earn an interest rate that’s even higher than the Tellus Boost Account, as reviews and data indicate. Vaults enables you to lock in a superhigh interest rate for a fixed duration in exchange for locking in your funds for the same amount of time.

The only thing you have to do is not withdraw your money for the duration of the term (though you can withdraw early from your Vault if you need to).

You can open a Tellus Vault for as little as $1,000 and fund it with your Boost Account or from a Stack or your external bank account.

There are no caps on how much you can deposit into your Vault, and you'll earn interest daily on your entire balance (and yes, it compounds daily like all other Tellus accounts).

Currently, the Vaults advertised interest rates are: 4.65% APY with a six-month Vault; 5.00% APY with a 12-month Vault; and 5.12% APY with a 24-month Vault.

Tellus Fees and Commissions

The accounts have no monthly fees whatsoever, and there's also no deposit required to sign up. However, while writing our review, we found that when you’re ready to fund your Reserve Account or Boost Account, a minimum deposit of $125 is required. The company does this to ensure your balance earns at least $0.01 every day.

The minimum balance of at least $125 also applies to each Stack you create. Vault requires a minimum deposit of $1,000 to start earning. While Tellus does not charge fees,your bank may charge fees based on its terms of service.

All Tellus products enable you to withdraw your funds at any time. Even though most transactions require only a day or two to process, some withdrawals can take up to seven business days, depending on your bank or credit union.

Tellus Security and Customer Support

Tellus is a financial technology company, not a bank, and thus isn’t FDIC-insured. Instead, Tellus protects customer deposits using what it calls its Triple-Layer Protection framework.

Namely, all your funds are backed by US-based residential real estate mortgages (with a geographic concentration in the US Pacific Northwest).

The loans that Tellus keeps on its balance sheet are always overcollateralized, which means that the value of the real estate backing loans is greater than the value of the loan amount.

In addition to real estate collateral, the company keeps extra cash in reserve as an additional protective buffer.

As of August 2022, the company notes that it backs each $1 of customer deposits with at least $1.30 of real assets, including the aforementioned real estate collateral and cash. Of course, the market value of real estate can change, which can affect loan-to-value metrics and coverage ratios like the one above.

Finally, Tellus protects your personal and financial data with bank-level security, including AES-256 encryption. If you have any questions or encounter any problems, you can feel good knowing that you can reach out for help via in-app live chat or simply leave a message through a contact form on the site.

Tellus customer service is available Monday through Friday from 9 a.m. to 5 p.m. PST, and the team is very responsive, so you should get a quick solution to whatever issue you’re facing.

Final Thoughts

Tellus is a great choice if you’re looking for a high-yield savings product. Reserve Account pays a base 4.75% APY on your deposited funds. Boost Account pays a base 3.85% APY with “power-ups” that increase your interest rate up to 6.10% APY.

Vaults pay up to 5.12% APY with no maximum balance limit. And Stacks let you easily budget and save for specific financial goals.

There are no fees associated with any of the accounts, and customer support is available via email or in-app live chat. Overall, Tellus is a great option for anyone looking for a simple and effective way to put their money to work and earn a high interest rate.

Further Reading

FAQ

Is Tellus legit?

Yes, Tellus is a legitimate company founded in 2016 and banked by J.P. Morgan Chase Bank.

Tellus boasts bank-level AES-256 encryption to protect your information and uses US-based residential real estate and cash held in reserve to back your funds.

Is Tellus free?

Yes, there are no fees. You can open an account and start earning interest on your deposited funds right away. T

here are no lockup periods, so you can withdraw your money at any time without penalty. The Boost Account and Stacks require a minimum balance of $125 to start earning interest.

How does the Tellus app work?

First, download the app from the App Store or Google Play. Your application will be reviewed in seconds. Once approved, you'll be able to sign in, and choose the account type you want. T

ellus uses Plaid and Stripe to securely link your bank account. After that, you can deposit money into your account and start earning interest. The company uses a service called Riskified to insure payments against certain types of fraud.

When you want to withdraw money, you simply transfer it back to your linked bank account, and it will be available within a few business days.