Trade The Pool (TTP) represents an evolution in the proprietary trading space, and the first specialized stock trading prop firm on the market. The platform was created and is owned by Five Percent Online LTD, the same company which operates the famous proprietary trading site The5ers.com

With Trade The Pool, you can trade more than 12,000 stocks and ETFs, including shorting penny stocks, on various US exchanges with up to $260,000 in buying power, clearly distinguishing the platform from other proprietary trading companies which are historically focused on Forex and contract trading.

One-time fee only

Fortunly Rating

Fortunly's Rating: Our editorial team determines the rating based on a set of evaluation criteria developed for each product and service category.

- You can trade in both pre and after market hours

- 24/7 customer support

- High user satisfaction

- Allows shorting penny stocks

- One-time fee

- Trading plan calculator

- Day and swing trading available

- 30-day free trial to Tradersync, Tradervue and Stock Traders Daily

- All evaluation programs (except Mini BP) allow 30-day free trial to Trade-Ideas, TrendSpider or Bookmap

- Profit splits could be higher

Trade The Pool Overview

TTP represents the next step in the focused approach to prop trading that the parent company Five Percent Online LTD, owners of The5ers, was built around. As with The5ers, which is primarily a Forex trading platform, Trade The Pool was created with a strict focus on stock prop trading.

This specialized business philosophy allows a website like Trade The Pool to offer an all-around world-class experience, tailored to a specific group of proprietary traders.

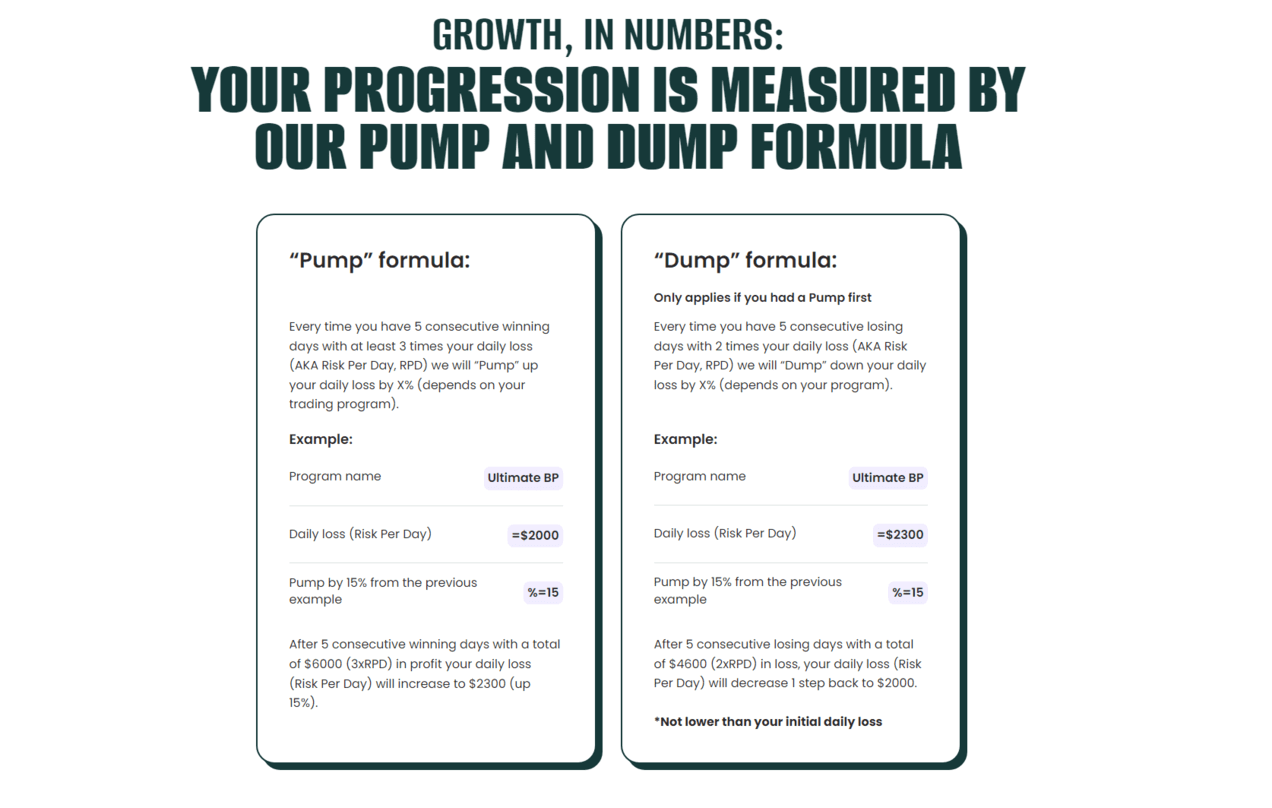

With more than 12,000 stocks, penny stocks and ETFs available to trade with, and special stock prop trading features like Pump & Dump (Growth) and Reset/Bypass, along with four different one-step evaluation account options, it already has a foundation as good as any other, older platform on the market.

Evaluation Process

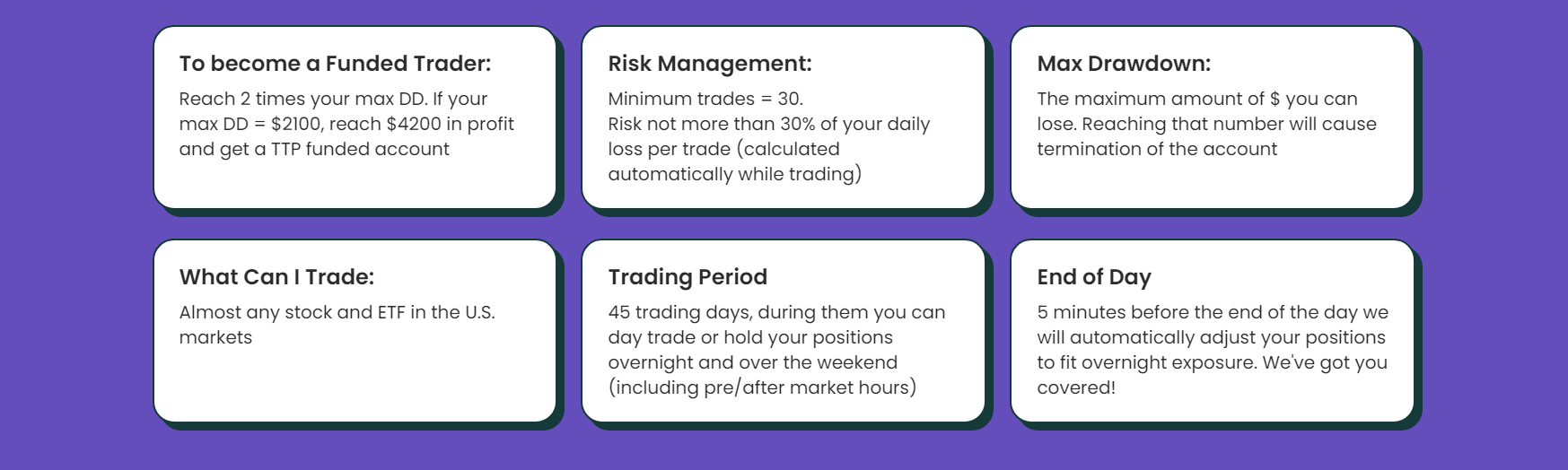

All traders have to pass a one-step evaluation process to gain access to a funded account, no matter which account size option you opt for.

The rules are also the same for all plans, and will require you to complete a minimum of 30 traders during a 45-day period.

To get a Trade The Pool (TTP) funded account, you will also have to reach 2 times your maximum drawdown (DD), meaning that if you opt in for a Mini Buying Power plan where the maximum drawdown is set at $900, you’d have to reach $1,800 in profit to become funded.

You also have to show off your risk management skills and not risk more than 30% of your daily loss per execution/order.

Losing the maximum drawdown amount set for your chosen plan will cause the termination of your account.

All evaluation programs offered (except the Mini Buying Power plan), come with free access to Trade-Ideas, TrendSpider or Bookmap.

Plans and Pricing

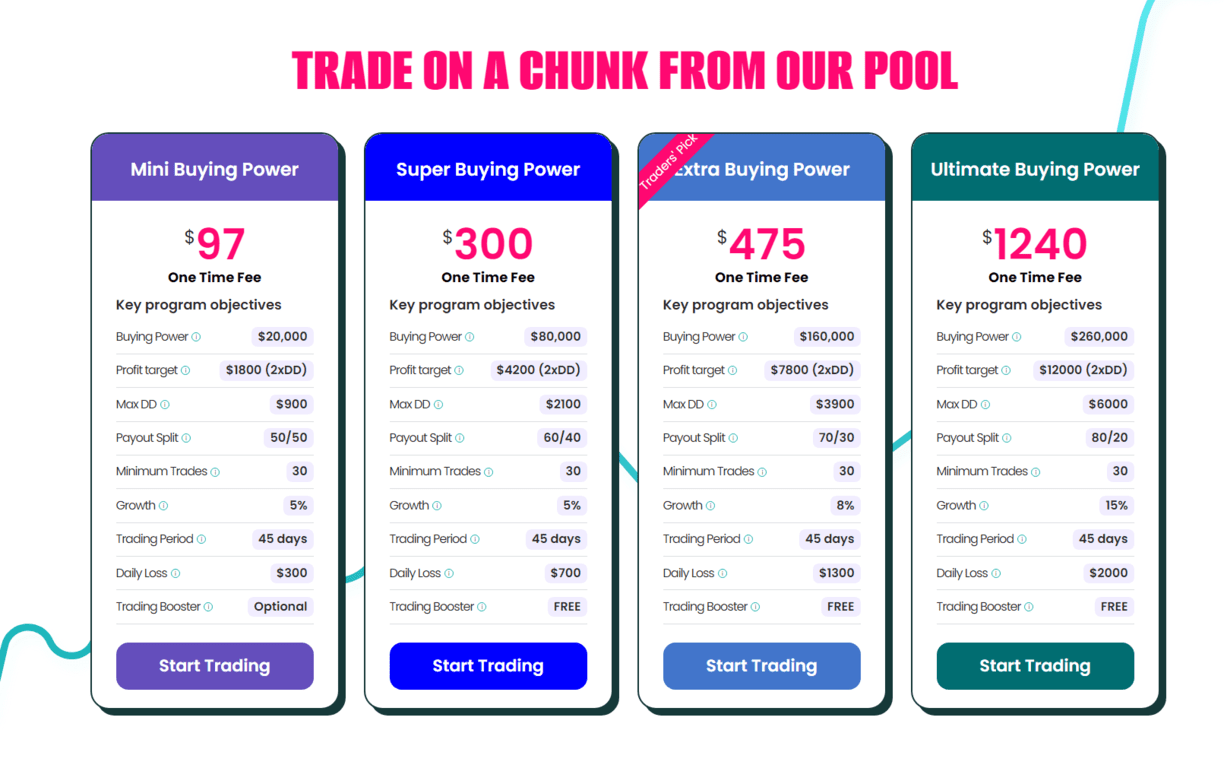

As we mentioned earlier, TTP offers four different plans to choose from, all with their different advantages and challenges.

The Mini Buying Power plan is best-suited to beginners, who have an opportunity to learn and upgrade to a higher level of challenge later, but the 50/50 profit split is also the lowest offered on the platform.

Later plans like the Extra or the Ultimate Buying Power come with much more favorable profit splits and offer ten times the buying power of the smallest plan, but they also come with much higher risk and potential for losses, and we recommend these options to experienced traders only.

You also have the option to opt in for a 14-day free trial and test out the platform and your trading skills in a risk-free environment.

Trading Platform

Trade The Pool uses their proprietary trading platform called Trader Evolution, specifically designed for professionals and with all the features that a prop trader needs on a daily basis.

These include market depth, super DOM, scalper window and scanners. The platform was built to allow a great access of personalization and can support your own trading style and strategies.

How Trade The Pool Compares to Other Trading Firms

Up to 80%

12,000+

Yes

From $97

Trader Evolution

Up to 90%

1,000+

Yes

From $99

MT4, MT5 (Some major stock trading features not available)

Up to 90%

1,500+

Yes

From $250

Eightcap M4, Eightcap M5 (Some major stock trading features not available)

Customer Support and User Satisfaction

You can reach the dedicated support system 24/7, either via email, phone or through the live chat option that’s available directly on the website.

From our experience, the support agents we chatted with were quick to respond and made sure that we got the help and the answers we needed.

As Trade The Pool is a fairly new platform, there aren’t that many customer reviews when compared to some of the more established names on the market.

Still, the company has an excellent 4.3/5 score on TrustPilot as of the time of the writing of this review, even though there are currently only 39 customer reviews right now.

Final Verdict

Trade The Pool can easily be considered the premier proprietary trading platform for stock trading available to traders in 2026.

The amount of specialized features and tools here is unlike anything else on the market right now, which, along with a great support system and a growing community of traders and resources available, makes Trade The Pool an attractive choice for stock prop traders of all experience levels.