How to Build an Investment Portfolio: Everything You Need To Know

An investment portfolio is a curated assortment of assets—including bonds, stocks, and mutual funds—held by an individual or institution. The main purpose of building an investment portfolio is to optimize the return on investment (ROI) while managing risk.

This ROI can manifest as interest, dividends, or capital appreciation. As an example, the average ROI for the S&P 500 in 2024 was about 38.6%. However, achieving such returns most definitely requires the expertise of a financial advisor.

Different Types of Investment Portfolios

There's no universal blueprint for investment portfolios. Your choice hinges on your financial objectives, risk appetite, and investment horizon. Here's a closer look at some prevalent portfolio types:

Growth Portfolios

Contrary to popular belief, growth portfolios aren't risk-free. However, they're generally less volatile than income-centric portfolios.

Many gravitate towards growth portfolios to fulfill long-term aspirations, like retirement. The strategy? Pinpoint companies poised for substantial stock price growth.

For instance, Nvidia's stock price skyrocketed by over 2,220% from 2019 to 2024, making it a darling for growth investors.

Income Portfolios

Designed to deliver consistent income, this portfolio model predominantly features dividend or interest-paying assets like stocks, bonds, and real estate. However, they often yield lower returns compared to growth portfolios.

Balanced Portfolios

At its heart, having a balanced portfolio is about not putting all your eggs in one basket. Imagine if you had all your money in tech stocks during a tech market crash. Ouch, right? But if you also had investments in other sectors or real estate, those could cushion the blow.

Index Portfolios

Reflecting the performance of specific benchmarks, such as the S&P 500, index portfolios stand out for their broad diversification, clarity, and cost-effectiveness. Their hands-off approach and the fact that they don't require active investment management has made them a favorite for those desiring a direct and uncomplicated entry into the stock market realm.

Steps to Building an Investment Portfolio

Constructing a portfolio is not solely a game of digits; it's the confluence of vision and logic, molded to fit your distinct goals and life's backdrop.

Define Your Investment Milestones

- Aligning Goals with Time: The duration of your investment journey plays a pivotal role. For instance, if you're charting a course towards retirement in three decades, you have the latitude to embrace higher risks compared to someone accumulating funds for an imminent home purchase.

- Gauging Your Risk Appetite: Investors are a diverse lot. While some thrive on the adrenaline of stock market gyrations, others seek solace in the predictable realm of bonds or the tangibility of cash. A thorough examination of your risk tolerance is instrumental in sculpting your portfolio's character.

- Tailored Financial Aspirations: Beyond the universal ambitions of retirement or wealth gain, you might harbor niche dreams. Perhaps it's ensuring a world-class education for your childen or owning a serene beachfront property. Recognize that each dream might beckon a unique financial strategy.

Curate Your Portfolio's Essence

- Strategizing Asset Distribution: The art of apportioning your capital across varied asset classes is crucial. While the "100 minus age" axiom offers a starting point, suggesting equity exposure should be the residual of 100 after subtracting your age, it's imperative to tweak this based on your unique financial landscape and aspirations.

- Choosing Your Investment Approach: Ponder over the degree of involvement you desire. Do you wish to dive deep, handpicking securities in an active investment style, or would you prefer the more laid-back approach of passive investments, mirroring market benchmarks?

Weave in Diversification

- Global Investment Tapestry: Refrain from anchoring your investments to a single geographical locale. Venturing into global markets not only unlocks avenues for potential growth but also offers a buffer against localized economic tremors.

- Industry-Wide Spread: Industries, be it tech, healthcare, or finance, have their unique rhythms in response to economic changes. Casting your investment net wide across sectors can shield you from industry-centric volatility.

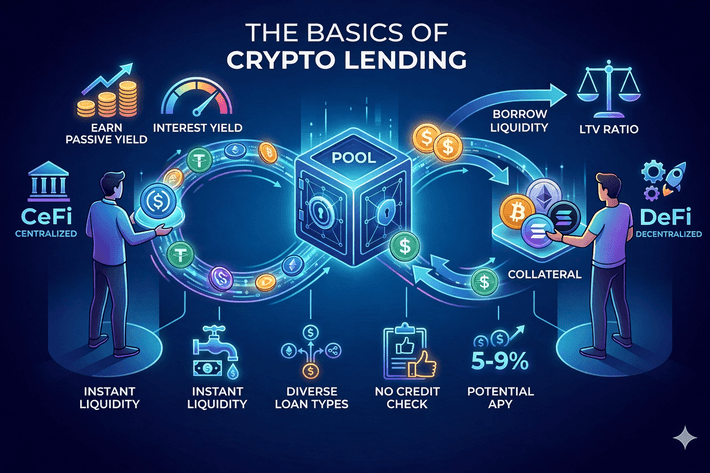

- Financial Instrument Diversity: Strengthen your portfolio by integrating a wide array of financial instruments, from ETFs and mutual funds to individual equities, bonds, and tangible investments like real estate or commodities. Additionally, consider delving into cryptocurrencies or peer-to-peer lending. Each instrument presents its unique risk-reward dynamics, catering to varied investment goals.

Periodic Portfolio Fine-Tuning

- Realigning Asset Balance: As time pushes on, certain assets might steal the limelight, causing a shift in your portfolio's original design. Periodic rebalancing, a process of restoring the initial asset balance, becomes essential.

- Tax-Savvy Decisions: When transitioning between investments, be aware of the tax implications. Employ strategies like tax-loss harvesting or optimize tax-favored accounts to ensure your returns aren't unduly eroded.

- Life-Change Adaptment: Life is a dynamic journey, with milestones like nuptials, the joy of parenthood, or career transitions. Ensure your investment strategy resonates with these life chapters, fine-tuning it to remain in sync with your evolving narrative.

Albert Einstein is said to have identified compound interest as mankind’s greatest invention. That story’s probably apocryphal, but it conveys a deep truth about the power of fiscal policy to change the world along with our daily lives. Civilization became possible only when Sumerians of the Bronze Age invented money. Today, economic issues influence every aspect of daily life. My job at Fortunly is an opportunity to analyze government policies and banking practices, sharing the results of my research in articles that can help you make better, smarter decisions for yourself and your family.