5KFunds offers a loan comparison service and connects borrowers with vetted lenders that offer some of the best personal loans on the market. The company has an extensive network of lenders that offer competitive rates and terms of two to 72 months for loan amounts ranging from $500 to $35,000.

APR range 5.99%-35.99%

Fortunly Rating

Fortunly's Rating: Our editorial team determines the rating based on a set of evaluation criteria developed for each product and service category.

- A network of 100+ lending partners

- Flexible terms and low fees

- Quick and easy online application process

- Fast funding times

- Offers options for individuals with low credit scores

- Funds are wired directly into your bank account

- Various types of financing available

- Complete loan process transparency

- Some lenders may perform a hard credit check

- No phone or live chat support

Thanks to its lenient borrower requirements, easy application process, and complete cost transparency, this borrower-lender matchmaking service has become a go-to solution for applicants who need to borrow money fast, can’t qualify for other funding sources, and are interested in only a soft credit pull.

5KFunds Overview

Owned and operated by Sincerely LLC, 5KFunds is a Florida-based online lending marketplace. 5KFunds isn’t a financial institution that issues loans. Instead, it provides a loan-comparison service that matches prospective borrowers with potential lenders.

Thanks to its network of more than 100 lenders, the platform gives borrowers with a steady stream of income access to several types of personal loans with competitive interest rates and flexible terms.

One of the best things about requesting a loan here is that you won’t be charged for loan-comparison services. As part of the initial application process, the 5KFunds provides a list of preliminary offers from many lenders, with no strings attached. Reject all the offers, and it won’t cost you a dime.

Should you find one of the lenders a good fit, you’ll be given an opportunity to review terms and conditions before making a commitment. This is an important step, as it allows you to determine if you have selected a reputable lender and if there are any hidden fees. Upon sealing the deal, you won’t need to wait for more than one business day for the money to arrive.

5KFunds can save you time on submitting applications to multiple lenders that offer personal loans. The online marketplace has no minimum credit score required or restrictions on loan purposes, which makes it an excellent choice for individuals who can’t qualify for funding from traditional sources.

How 5KFunds Compares to Other Lenders

5.99%-35.99%

N/A

3.99%-35.99%

580

2.49%-35.99%

N/A

Financing Types

5KFunds connects a user with a lender that offers unsecured personal loans, which can be used for covering unexpected expenses, debt consolidation, and other purposes.

Personal Loans

Individuals looking to borrow $500 to $35,000 with loan terms ranging from 61 days to 72 months have good prospects for borrowing through 5KFunds. Whether you are looking for a payday loan, debt consolidation, or a secured or unsecured personal loan, the 5KFunds network of more than 100 lenders is probably wide enough to offer you several competitive deals.

Our research reveals that although 5KFunds is lenient regarding credit scores and histories, many members of its lender network are more strict. Some borrowers will not qualify for the lowest annual percentage rate or for unsecured loans. Individual lenders have the final say when it comes to determining an applicant’s eligibility and the minimum credit score requirement.

In other words, while 5KFunds may offer personal loans from multiple lenders to poor credit score borrowers, there are no guarantees. The best rates, fees, and loan repayment terms are reserved for applicants with high incomes and excellent credit scores.

Application Process

To start the online application and pre-qualify, you’ll need to take the following steps:

- Click Get Started to be redirected to the site’s application form.

- Select the desired loan amount and term range.

- Fill out the required personal and basic financial information.

- Upload requested documents.

- Wait for 5KFunds to verify your information and confirm loan availability.

You’ll also be asked to submit the following:

- Personal details: your full name, address, email, and valid contact number

- Employment information: your employer’s name, employment duration, gross monthly income, payment frequency, and pay date

- Proof of identity: passport number, driver’s license number, Social Security number, or equivalent

- Active bank account number and other bank account information, including whether your account allows direct deposits

Finally, you'll need to state whether you’re a military member on active duty.

Once you’ve submitted your application, 5KFunds will search its network of more than 100 financial institutions for matches. You won’t need to wait more than 10 minutes for a list of suitable lenders. At this point, you’ll be given an opportunity to browse through the preliminary offers and compare them before selecting one for a full application.

5KFunds and its lenders may perform a soft credit check to determine your loan eligibility and review data from all three consumer credit reporting agencies: Experian, Equifax, and TransUnion.

Upon approval, you can expect funds to arrive in your bank account via wire transfer in less than 24 hours. If you sign your loan agreement on a weekend day, you’ll need to wait until Monday for the transaction to process.

Funding Features

As advertised on the company’s website, 5KFunds' loan-comparison services comes free of charge. Each personal loan comes with fees and interest charges payable to the lender. To make sure that you’re choosing the best personal loan, we suggest you take the time to read through the terms carefully before accepting the final offer and signing your loan contract.

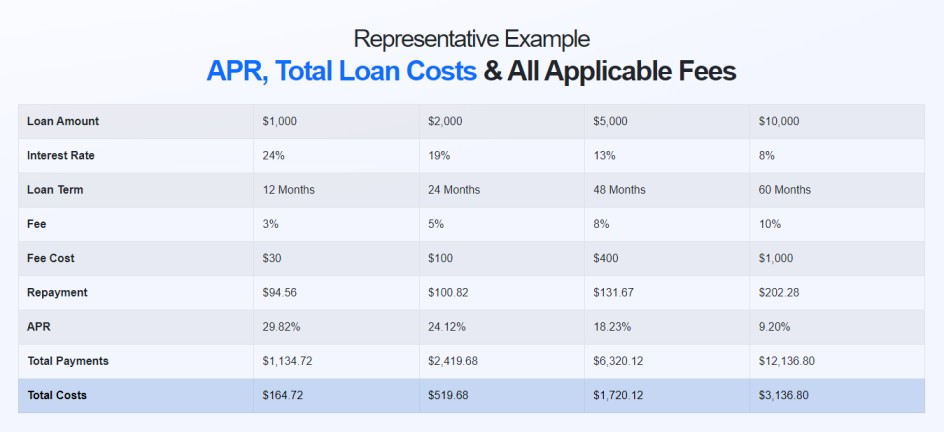

Loan Amount and APR details

5KFunds provides a solid range of personal loan amounts along with flexible terms and somewhat affordable interest rates.

5KFunds does not impose income or credit-score minimums on potential borrowers. However, the preliminary terms provided by 5KFunds may not match the funding options you receive from lenders, and some lenders may impose income or require a credit report showing a good score.

The exact terms offered by the lending partners will depend on information such as your income, employment history, credit score, and credit history. Here are some of the options provided by members of the lending network:

- Loan amount: $500-$35,000

- APR: 5.99% to 35.99%

- Loan term: 61 days to 72 months

- Fees: Vary from lender to lender

- Collateral: Depends on the lender

- Repayment options: Every two weeks or monthly

Before agreeing to a loan, you should always research the lender’s offer for additional charges such as origination fees, closing costs, late payment fees, and prepayment penalties. Given that 5KFunds only operates the lending marketplace and doesn’t guarantee the terms, it’s your responsibility to double-check the lender’s policies before making a decision.

Eligible and Non-Eligible Applicants

5KFunds has relatively liberal eligibility criteria for borrowers, with no minimum credit score required. These are some of the requirements you’ll have to meet:

- You must be a citizen of the United States

- You must be at least 18 years old

- Your source of income must be steady and legitimate

- You need to have a bank account, preferably with direct deposit capabilities

There are almost no restrictions on how borrowers can spend their loans, and you get the money you need without having to demonstrate it is for a lender-approved purpose.

The most common reasons to apply for a loan from a personal finance company include:

- Personal purchases

- Wedding expenses

- Unexpected medical expenses

- Repaying debts

- Budget constraints

- Home renovation and repairs

- Emergency funds

- Functions and events

Repayment Terms

This review wouldn’t be complete without mentioning that loans provided by Sincerely LLC’s lending partners come with terms ranging from 61 days to 72 months. Depending on the lender’s policy and your preferences, personal loan payments can be made monthly or every two weeks.

With most loan providers, you’ll be able to choose between automatic deductions from your bank account or manual payments according to a specified schedule. Regardless of what you choose, it’s always a good idea to read all the fine print.

Missing a payment, being late, or rolling over a payment are likely to have financial repercussions in the form of fees and can negatively affect your credit score. On the bright side, paying off your loan on time may improve your chances of getting a better deal on future personal loans and other financial products.

Customer Satisfaction

Not many customers testimonials can be found online. 5KFunds has a 1.5/5 star rating on Trustpilot, but to be fair, the rating is based on only 69 reviews. Most of the negative ones seem to have come from users who think the company funds borrowers, which is not the case. 5KFunds is not a lender itself but rather connects users with lenders in its network.

Sincerely LLC, the company which operates 5KFunds, has an F rating from the Better Business Bureau (not accredited).

Final Words

If you are in need of quick cash – an unsecured loan, payday loan, or debt consolidation loan – you’ll find the automated loan-application process fast and convenient.

While we would like to see the company expand its range of loan amounts and add educational resources to its website, its simple application process, fast funding times, and flexible terms make 5KFunds a good choice for almost anyone looking for an alternative funding source.

If you are looking for a quick and effective way to fund almost any personal project, you’ll appreciate the liberal qualification requirements and transparent borrower-lender matchmaking service provided by 5KFunds.