Keeping track of your tax obligations seems to be constantly growing more complicated, especially if you add cryptocurrencies to the mix.

Suddenly, there’s more work to be done on calculating what you owe to the IRS than finding crypto investment opportunities or making trades.

Thankfully, there are software solutions that can make your life easier and save you time with tax reports.

One such platform is Koinly, and we are here to provide you all the information you need to know before deciding if it’s the right tool for your tax needs.

Free plan and mobile app available

Fortunly Rating

Fortunly's Rating: Our editorial team determines the rating based on a set of evaluation criteria developed for each product and service category.

- Best choice of integration options

- Comprehensive crypto portfolio

- 17,000+ cryptocurrencies supported

- Support for NFTs

- Affordable plans for regular investors

- No dedicated tax harvesting features

- Tax forms only with paid plans

Koinly is a company founded in 2018 by a team of cryptocurrency investors. It’s one of the first companies in the industry to create a comprehensive solution that covers various transactions, transfers, investments, and fees and produces comprehensive reports.

The company has so far filed more than 11,000 tax reports and is tracking $250 million in funds.

It supports some of the widely used exchange accounts and wallets and has plenty of features that both experienced and new investors will appreciate.

Key Features

Koinly has been developed with individual users in mind, but this doesn’t mean it doesn’t have a use case for businesses or accounting firms.

Tax Report Integrations

It’s important to mention that Koinly integrates with multiple exchanges, wallets, blockchains, and services. It syncs data without compromising the security of your accounts or requiring you to enter private keys.

The integrations include more than 390 exchanges, such as Coinbase, Binance, Crypto.com, Bittrex, Kraken, Poloniex, and Bitstamp. If you are using any of the high-profile crypto exchanges, chances are it’s supported by Koinly.

All wallets we recommend for storing and using Bitcoin are supported by Koinly. Furthermore, the platform for tax reports differentiates between wallets you own and incoming transactions and investments.

Therefore, any transfers between addresses you own don’t count towards calculations of your taxes.

Anyone aware of projects such as Ethereum knows there are many other cryptocurrencies powered by the platform in question.

Koinly supports ERC-20 tokens and integrates more than 17,000 cryptos in its calculations. With Ethereum’s shift towards proof of stake, many investors may find it an interesting opportunity.

Portfolio Tracker

Koinly can also be used as a crypto portfolio tracker. Since you’ll likely integrate all your wallets and exchange platforms to get the most out of the software, you will have complete insight into your portfolio.

Tax Reports

Koinly will inform you of your exact return on investment, comparing it with the fiat currency you’ve used to buy your coins and tokens. The app can track:

- Gains and losses in real-time

- DeFi

- NFTs

- Futures

- Margin and futures trading

- Historical prices

- Airdrops

- Forks

- Mining and staking

Since you can integrate wallets and exchanges, Koinly can also show you how much of your crypto asset is distributed on exchanges and in the fiat currency of your choice.

You have an excellent overview of all your transactions and can filter them out or track specific ones.

With Koinly’s tracking system, you can accurately track your income from staking, mining, or earning from other crypto income sources such as lending or providing liquidity.

One of the app's key features is a straightforward method of preparing your tax documentation. You can generate a filled-out Form 8949, but tax software isn’t limited exclusively to the US.

Supported Countries

Besides the US, Koinly can calculate taxes for the UK, Canada, Australia, New Zealand, France, Germany, and many other countries. Officially, it can make international tax reports for more than 100 countries.

Additional accountancy methods that the platform supports are:

- Highest Cost

- Average Cost Basis

- First In First Out (FIFO)

- Last In First Out (LIFO)

How Koinly Works

Using the app is straightforward. After filling out the required information or simply signing up with a Coinbase or Google account, you are prompted to import all your accounts and wallets holding cryptocurrencies.

As you can see, searching for the appropriate platform can be done quickly by using the search bar at the top, and you can filter results by categories such as exchanges, wallets, blockchain, and services.

For example, if you want to track ETH you are holding at MyEtherWallet, you have the option to import transactions from a CSV file, API integration, or set up auto-sync.

Most users won’t have issues importing data from a file, as the app provides detailed instructions. However, the easiest method is simply adding your public address.

You can then choose a point in time from when to import transaction history in case you’ve already settled your tax obligations for the year before.

Koinly will show you an overview of all your wallets and exchanges. From there, you can search, sort, delete and add other sources.

As previously mentioned, if you review the dashboard, you’ll be able to keep track of received and sent transactions, gains, and losses. The app also shows you the balance of each individual asset and the balance of all assets.

You can also track individual transactions for a more in-depth review.

Generating a tax report is as easy as clicking a button. Before you proceed, you will be able to examine what Koinly has found from your assets:

- Capital gains tax on profits and losses

- Gains from sources such as futures and derivatives

- Income from airdrops, forks, and loan interests

- Deductibles such as costs and expenses

- Lost assets, gifts, and donations.

However, to take the best advantage of having complete tax reports, you’ll need to have a paid version.

Pricing

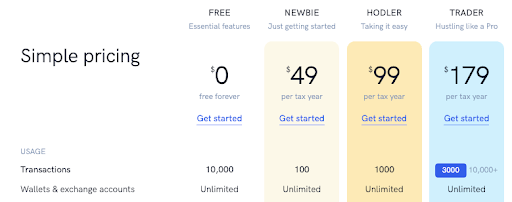

Koinly has five subscriptions available: Free, Newbie, Hodler, Trader, and Pro, which has two different options for the number of transactions it can process.

Free

The Free plan has all the features that paid plans have, with the significant difference of not being able to fill out and print tax reports. It also lacks the custom file import function, cost analysis, and email support.

Newbie and Hodler

Newbie and Holder subscriptions cost $49 and $99 per tax year, respectively. The main difference is that the Newbie plan can be used just for 100 transactions. The tier ironically named Hodler can process up to 1,000 transactions for an annual tax report.

You’ll notice that on the website pricing page, email customer support is only listed for the Trader option. That’s an error - all paid plans include it.

Trader

The Trader subscription is the most expensive out of all plans, but if you are a prolific trader in a single tax year and have up to 3,000 transactions, you’ll have to pay $179 to get a comprehensive tax report from Koinly.

Pro Plan

The Pro plan is for users with more than 10,000 transactions. It costs $279, and unlike other plans, it can be customized. For every 1,000 transactions over the cap, you can pay an additional $10 to include them as well.

Payment Methods

Until some time ago, paying with cryptocurrencies wasn’t an option on Koinly, but the platform has acknowledged that many users would prefer using crypto. Therefore, you can now pay with Bitcoin, Ether, Litecoin, USDC, and DAI. You can use Visa, Mastercard, and American Express payment cards if you want to pay with fiat currency.

Additional Options

Besides regular offers on the website, there are some additional options you can enable according to your preference.

If you want Koinly to check daily and automatically update your transactions, you can pay an extra $49 for the Daily Sync option. Like the subscription, it lasts for a period of one year from purchase.

If you hold dual citizenship, you must file taxes in both countries, and Koinly recognizes that many of their users are expats.

For $49 extra, the Dual Nationality option enables you to print an additional report for another jurisdiction.

How Koinly Compares to Other Crypto Tax Software

$0-$279

From 100 to 10,000+

$0-$199 (plus individually priced plans)

From 25 to unlimited

$49-$299

From 100 to unlimited

Koinly certainly isn’t the only platform finding its place among many tools used by crypto investors. It’s quite popular, though, since both individual users and professionals like accountants can use it.

But how does it stack up compared to the competition? We’ve compared it to some of the most popular alternatives listed among our recommended crypto tax solutions.

Koinly vs. CoinTracker

CoinTracker is primarily a portfolio tracker with features that can turn it into a potential money saver for you. The app will point out if you have tax-loss harvesting opportunities and stay compliant.

Both Koinly and CoinTracker have plenty of integration options, but CoinTracker has the upper hand here, offering Binance and Trust Wallet.

Neither platform limits the number of exchanges and wallets you can use. We found that CoinTracker supports fewer wallets than Koinly.

Customer reviews on Trustpilot are much more positive than for CoinTracker. Koinly has a high 4.7 out of 5 rating, while CoinTracker sits at 3.2.

Some users complain that CoinTracker can’t track NFTs or accurately represent their price. Many issues cited by users remain unresolved, as CoinTracker’s team is less responsive than the Koinly support.

Both platforms have similar pricing for base packages. However, Koinly is much more affordable when processing more than 100 transactions in a single tax year.

Keep in mind that CoinTracker can calculate taxes only for the US, Canada, UK, Australia, and India. For everyone else, the app can give you a capital gains summary, which you can use to calculate your obligations toward the state.

Koinly vs. CryptoTrader.Tax (Now CoinLedger)

CoinLedger was founded in 2018, the same year as Koinly. Both development teams had a similar goal; therefore, both tools have tax software and portfolio tracking. CoinLedger also has useful resources on various tools you can use for investing and staying tax compliant.

CoinLedger does include NFTs, and you can import your NFT trades as the platform pulls data directly from the blockchain. If you have a professional accountant, you can add them as a user to your account and have them file taxes instead of you.

CoinLedger’s main advantage over Koinly is a tax loss harvesting report and perhaps the main reason for larger investors to decide on using it. If you offset capital gains with losses, you may end up paying less on your primary crypto assets.

CoinLedger’s list of supported countries is much shorter than Koinly’s and could be the deciding factor for you. User reviews for both platforms are quite positive, with CoinLedger having a bit higher score of 4.8.

Koinly once again shows that it has a competitive price. However, CoinLedger pays off if you have significantly more than 12,000 transactions per year.

CoinLedger can create tax documents from 2010, while Koinly goes a step further and includes 2008 and 2009.

Our Verdict

Any serious investor will agree that compliance with appropriate tax forms, localized tax reports, and insights into your portfolio are basic tools you must have.

With Koinly, you don’t have to rely on CSV files and Excel tables to keep track of your transactions, and you can concentrate on the investment strategy and research how to expand your portfolio.